admin

This user hasn't shared any biographical information

“Do not lie down but stand up and fight them!"

And so it was, that, in relation to an Equity Release fraud case in Spain against Danske Bank Luxembourg, the defendant held the following:

We conducted our due diligence according to the internal rules and procedures Danske Bank Luxembourg has in place. As part of this process, the Capital Assurance product, sold on the basis of a tax-planning proposition, was fully cleared by KPMG. We therefore reject the claimant’s action for it is groundless, without merit, and we will defend ourselves vigorously.

Fully cleared by KPMG? What does that really mean in Danske Bank Luxembourg banking jargon?

Mr. Klaus Mønsted Pedersen: have you read the attached document by KPMG Madrid, denying that they ever gave the blessing to the cash-predatory tax-evading Capital Assurance Product, ever authorized your company to use their name and in fact, formally requested you to eliminate from the brochure any reference to the product being approved by KPMG?

Klaus Mønsted Pedersen, Managing Director of Danske Bank International (Luxembourg) and the man behind the products developed to provide efficient cross-border tax-planning seemingly ensured that, prior to launching his state-of-the-art Capital Assurance, a thorough compliance job had been carried out.

Klaus Mønsted Pedersen, Managing Director of Danske Bank International (Luxembourg) and the man behind the products developed to provide efficient cross-border tax-planning seemingly ensured that, prior to launching his state-of-the-art Capital Assurance, a thorough compliance job had been carried out.

To that effect he tied up loose ends, dotted the i’s and crossed the t’s, and attended to detail. Because detail mattered.

And to not leave anything to chance, the website conveys a clear message: that tax benefits adapt to local legislation, and to make sure that there is no mistake, such benefits for Spain are confirmed by no less than a Big Four, KPMG.

Spectacular display of Danish efficiency, in case we had any doubts; and not a chance in hell for those who signed up for the Capital Assurance + Spanish Hipoteca, two air-tight contracts drafted by top law firms that are virtually unbreakable.

Such is life.

Or so we thought…

For Sparlolland, previously Finansbanken A/S, selling a 2,5 million Euros Equity Release product to a Marbella-based artistic painter was a matter of discussion over a cofee, or two, at the Guadalpin Hotel.

We cannot even imagine what sort of bullshit was the poor man fed by Maria Tremurici-Falter, Marbella-based retiree that occupies her time doing anything from advising people on how to multiply their money by making the right decisions to organizing charity dinners, Michael “Mich” Weisz, a man that ran The Mortgage Company and is now awol, and Pernille Bering, from the bank.

The unfortunate life-changing meeting lasted, according to the bank, between 1.5 hours and 2 hours, time enough for a painter devoted to German expressionism to digest a course on Danish-bond historic performances, Luxembourg-based Lex Life insurance wrappers taxation and the real meaning of Security Coverage Ratios.

Next morning, he was sitting in front of a Notary Public, these useless social parasites who actually do manage to do their work correctly: check that your face matches that of your passport.

SPAIRS , the Spanish Property and Income Release Scheme, concocted initially by Charles Walton, from Premier Group, and later adopted by greedy banks and rogue IFAs such as Henry Woods, caused extensive havoc.

Reading the attached article, it compares well with that of Dewsnip, from Rothschild (published on the post of the 6th December) , from which it has taken full inspiration; in fact, we think that either party should take action for plagiarism.

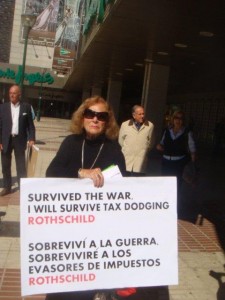

Despite attempts by Rothschild to discredit pensioners who allege that hard-selling

IFAs were put in place by the bank, hard evidence is hard to remove.

The second page of Steve’s article proves that not only were both companies well in bed professionally, they were also jointly throwing multitudinous parties where we can only imagine that beer and booze were not in short supply.

At ERVA, we are keen to substantiate any  allegations we make so, if there is proof that the attached is a fabrication by all means, we will have it removed.

allegations we make so, if there is proof that the attached is a fabrication by all means, we will have it removed.

It is difficult to find a more interesting and profound reflection by financial-guru Stephen Dewsnip.

It is difficult to find a more interesting and profound reflection by financial-guru Stephen Dewsnip.

In his trip to trying to describe a product that is a mortgage loan but then, it isnt’t really one, he has tripped badly.

Firstly he admits that people, naturally, are reluctant to take out a mortgage after a life working hard to rid the property of it. He then says that if a mortgage is required, no worries, innovative Rothschild is going to look after everyone and will not allow anything but careful handling, thanks to their ultra-cautious approach.

A few years later, Claire Whip-ett, who back in the day would review Stephen’s articles to make sure they were accurate, flies out to Spain to give a warning to their one-time customers turned enemies: pay up or we will take your properties.

Where is the limit with these people?

ERVA seems to have a fixation with Rothschilds when it comes to exposing the cheek and skullduggery of bankers, but this is not the case; it is rather that this sadistic and innately sinister corporation, intent on perpetuating stress-related ailments on people who were otherwise perfectly healthy -financially too- can hardly raise any sympathies.

Victims of this company’s plan to deceive expats generally express a familiar emotional pattern, when talking about this scheme: their worries quickly dissipate and give way to anger and fury, more so when they find out, to their horror, the pack of lies they were subjected to.

In 2012, Rothschild is saying this:

Hamiltons were your financial adviser and acted as your agent in relation to your application for a CreditSelect loan facility, we are not able to accept responsibility for any advice that may have been given to you by Hamiltons.

But in 2006, Rothschild was saying this:

Our innovative product CreditSelect is available throughout a network of financial advisers around the world, thus giving clients straightforward access to credit for a while range of purposes…”

To Help Support those professional financial advisory firms with whom we have agreed terms of business for the availability of CreditSelect, we have a website dedicated to assisting the promotion and delivery of the service…”

This website is regularly updated to ensure that our introducers have round the clock access to all facility documents for downloading and printing…clients brochures, the latest Funds List…”

Our product CreditSelect has been so successful that we have restricted its availability to a handful of quality introducing intermediaries”

Mr. Mark Countanche and Mr. Peter Rose, a piece of advice: your compulsive lying is going to take you nowhere, given the crystal-clear evidence of paper trail you have left behind, not to mention that you actually taught, trained, coached and instructed Hamiltons Financial Services, Henry Woods Investment Managements and others, accordingly.

Change your strategy, change your lawyers and do it fast. Oh, and avoid “unworthy of trust” firms that are just clocking up hours regardless of the quality of the advice they are giving, being with the “largest firm” will just not help you.

A few posts ago we wrote about a complaint filed by no less than 180 victims of the Equity Release scam; now we have a video, partly in French, where some victims and their lawyers explain to the Luxembourg press the reasons for bringing the Landsbanki Criminal Complaint.

A few posts ago we wrote about a complaint filed by no less than 180 victims of the Equity Release scam; now we have a video, partly in French, where some victims and their lawyers explain to the Luxembourg press the reasons for bringing the Landsbanki Criminal Complaint.

Legal grounds for bringing such an action seem clear and undisputed:

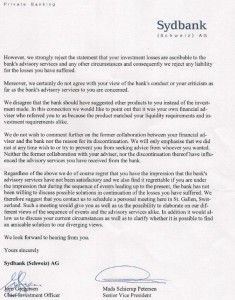

Sydbank is the worst Equity Release offender, by far, in terms of lack of regulatory compliance for the laws in Spain.

The list below shows the shocking contempt displayed by Sydbank for the host country’s laws when offering the tax-evading Equity Release to British unencumbered properties owners living in Spain:

All of this has already cost them dearly: the Sydbank branch who signed the attached last page of the risible missive was closed down following the spate of damning articles, openly accusing the entity of tax evasion, published in the Danish press.

One thing Julia found most upsetting was the fact that she is of Jewish descent, just like Rothschild are reported to be, in spite of which she was taken in by her coreligionists with false promises of Inheritance Tax benefits and regular income. The Daily Mail covered her story and yet, Rothschild deny any wrongdoing. They are currently basi ng their legal defence on 2 items:

ng their legal defence on 2 items:

By employing two full-time credit analysts within our Banking Team dedicated to researching and analysing offshore mutual funds, we are able to accept a wide range of investments provided by major fund management groups as collateral for CreditSelect Loans.

CreditSelect has been so well received that we have had to restrict its availability to just a handful of quality introducing intermediaries throughout the world.NMR DISPATCH AUTUMN 2001