AFP January 30, 2014 at 17:50

Three former executives of the Luxembourg subsidiary of the Icelandic bank Landsbanki were indicted for fraud in Paris, announced Thursday AFP a source close to the case.

The court granted prior information on the Icelandic financial crisis of 2008 mortgage was opened in 2009 after complaints from individuals who are victims of this controversial financial product, including Enrico Macias singer.

Before the investigation, Judge Renaud van Ruymbeke has already indicted in 2011 Luxembourg subsidiary in bankruptcy for “fraud” and “lack of approval.” The judge placed under judicial supervision with the obligation to pay a deposit of € 50 million, a record amount in France.

It is now the men who sold the loan that are covered in a folder at the root of a showdown between the French and Luxembourg justices.

In recent weeks, Mr. van Ruymbeke delivered indictments for “scam” of three former executives of the bank: Torben Bjerregaard Jensen, a Danish national, Olle Lindfors, a Swede, and Failly Vincent, a Belgian, according to the source familiar with the matter.

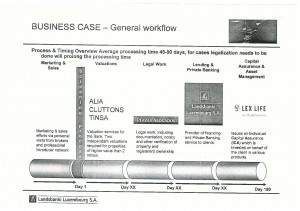

Cash-strapped, Landsbanki has offered through its subsidiary in Luxembourg from 2006 to 2008 for individuals to mortgage their homes in exchange for favorable loans.

Assembly, complex, meant that the borrower receives a portion of the sum, while the bank reinvested the rest markets. The value of this portfolio would grow to the point of covering all aspects of the loan, which was repayable upon its conclusion.

“In this scheme, the bank was never losing,” said another source close to the case, the fraud totaling tens of millions of euros. “If things went well, everyone won. If things went wrong, the bank recovered a house. ”

Before the judge, the three men indicted contested that Landsbanki Luxembourg could promise customers that the investment returns would cover all repayments, according to a source close to the investigation.

Entering receivables

Hundreds of individuals, particularly in the south of France, Spain and Portugal, had signed these loans.

But in the wake of the bankruptcy of the Lehman Brothers bank in September 2008, several Icelandic banks had collapsed, including Landsbanki, which was nationalized in emergency.

Consequence of the crisis, the investments offered by Landsbanki Luxembourg have lost much of their value. Moreover, some of these investments were other than obligations of the parent company. Paid once for subscribers to find other means to repay their loans.

Where complaints of fraud by these individuals, some of whom have been ruined. They accuse the bank knowingly proposed financial package without checking the repayment capacity of clients.

The case is also played in Luxembourg. In bankruptcy, a subsidiary of Landsbanki has assigned its subscribers before the Justice of the Grand Duchy to enforce the loan guarantee-to-sell the mortgaged homes in order to pay its own creditors, chief among them the Central Bank of Luxembourg.

In early 2012, the Luxembourg court objected that the liquidator of the subsidiary pays the deposit of € 50 million ordered by the French justice.

At the request of the plaintiffs, Judge van Ruymbeke responded by ordering the seizure of mortgages held by the bank on several investors. A decision which has theoretical consequence to prohibit Landsbanki claim to French investors the loan.

However, the bank appealed that decision in an appeal that will be reviewed in February by the investigating chamber of the Court of Appeal of Paris.

AFP

Source: http://www.liberation.fr/economie/2014/01/30/trois-ex-cadres-de-landsbanki-luxembourg-mis-en-examen-pour-escroquerie_976644