Bill Blevins, the man that has lent his name to the company Blevins Franks, can be said to be one of the few that, when it comes to Equity Release, did the right things.

By partnering with Seniors Money Lifetime Loans, his company offered a serious, comprehensible and a more or less transparent service to equity rich expats, yet in need of cash, living in Spain. Or, at the very least, we could not find a search-engine enquiry result similar to the barrage of negative comments in respect to the truly fraudulent schemes this site is all about.

But doing things right did have its drawdowns: local land registries kept turning down the registration of many clauses of these mortgage loans because they did not adapt to mortgage laws. Seniors Money Spain Finance Ltd., not content with the antics of overzealous registrars within their jurisdictional fiefdoms, chose to appeal every single of the registrars rejections to register the “reverse loans” (at least 10 that we know of) to the Directorate General of the Land Registries and Notaries (DGRN), who partially accepted the claims (the decisions are mostly copy-pasted).

The Registrars, who had previously mocked the work of lazy Notary Publics by questioning their legal capacity, went to new heights by challenging the decision of the DGRN (their bosses), in Court, because the top brass of these privileged casts had issued their legally binding opinions…a wee bit late! And won!!

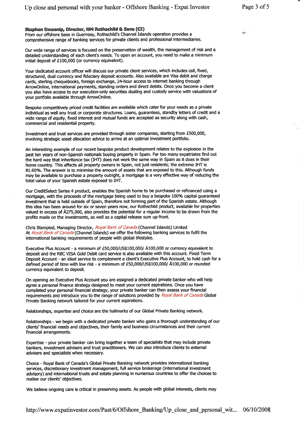

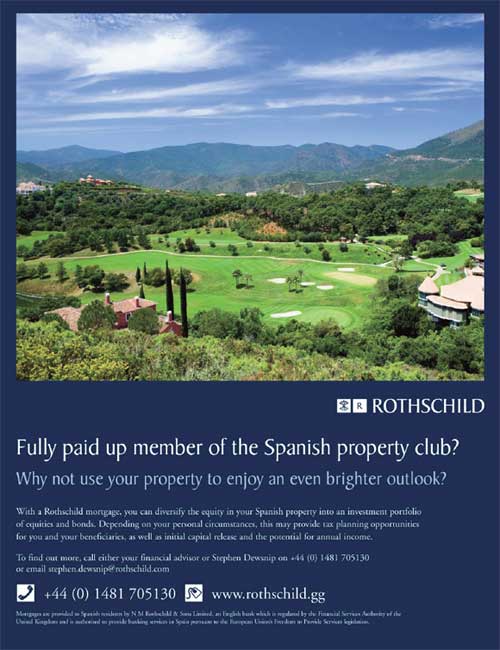

Such a mess could have easily been prevented by doing what other banks did so well: just cheat. Rothschild, Nordea, Jyske and a few others went down a straight line and signed straightforward mortgage loans to expats who thought they were being sold a reverse mortgage.

As Steve Dewsnhip put it: it is a mortgage loan that is not really a mortgage loan, so don’t you worry.

ng their legal defence on 2 items:

ng their legal defence on 2 items: