admin

This user hasn't shared any biographical information

“Do not lie down but stand up and fight them!"

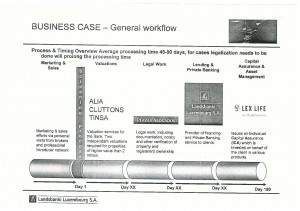

Surely lawyers representing the claimants in the criminal complaint against Landsbanki would have had this workflow diagram explaining how the Equity Release scheme was perpetrated.

Surely lawyers representing the claimants in the criminal complaint against Landsbanki would have had this workflow diagram explaining how the Equity Release scheme was perpetrated.

Conversely, if the scam was so obvious, we wonder why lawyers acting for Landsbanki, if we consider them professionally able to resist the appeal of abundant legal fees, did not take exception to this aberrant product sold tranquil risk-averse retirees who had achieved in life a dreamed aim: having no mortgage.

How come did they no spot a clear deception marked by such a noticeable violation of the laws and the morals?

More and more questions to the participants who still today…observe a total yet suspicious silence.

Victims of the Landsbanki Equity Release scam have filed a complaint against the bank Landsbanki for criminal swindle.

Victims of the Landsbanki Equity Release scam have filed a complaint against the bank Landsbanki for criminal swindle.

The lawyers involved in the action, Bernard Maingain and Benjamin Bodig, have presented compelling evidence proving that retirees living in France and Spain, who had small cash requirements to improve their living conditions, were approached by the bank who in turn, offered to mortgage their properties in full and place the proceeds in investments that would generate enough to pay off the costs, and bring an income stream.

Far from it; according to the lawyers, upon examination of the product it would have been clear to the bank that this would have never worked because in fact, the proceeds were placed in highly speculative investments.

Mr. Maingain and Mr. Bodig were categorical: “A product that turned out to be highly speculative was in fact sold as a risk-free diligent-head-of-family-investment product.”

They conclude by calling to the European judiciary to put the means to assist victims and their lawyers in what is a flagrant financial scandal of European proportions.

We know what Nordea Bank Luxembourg will say about the part they played in this scam: “we deny any wrongdoing” and “the client always had the opportunity to seek alternative advice”. Certainly clients had the opportunity to go elsewhere to seek true and accurate advice, but they did not, they trusted their inherent Nordic values that John Mortensen and his foot soldiers boasted as capable of “differentiating them from their competitors”.

—

Original Story: Luxembourg: Plainte au pénal contre Landsbanki (29-11-2012)

Members of the ERVA are to file a group action against Rothschild for misleading publicity, in respect of the Equity Release, at the provincial Mercantile Courts of location of the property affected.

Members of the ERVA are to file a group action against Rothschild for misleading publicity, in respect of the Equity Release, at the provincial Mercantile Courts of location of the property affected.

Legal grounds for bringing such an action are 2, mainly:

The claim, which is to follow the same format as the Nordea Claim, is to be filed on the 20th of December 2012.

Other than that, we would not wish to miss this opportunity to briefly comment on the attached information, one of many examples of abundant tax-evading publicity that Rothschild produced.

A calm and unflustered Steve Dewsnip, a prominent Rothschild figure when the scheme was going strong on the Coasts who is currently doing other things, spoke and wrote like a Spanish Inheritance Tax expert. Far from it, the man was just clueless.

But the worse we think was the use of an unsettling word, “bespoke”, to ill-define the nature of this absolutely commoditized deceiptfully predatory product sold to pensioners, without distinction and without, of course, any semblance to the meaning of it.

Prolific activity by Rothschild and Surrenderlink (SLMB) back in the days of cheap money translated into more and more victims.

Peter Male Financial Advisors had its pros and cons:

Peter Male Financial Cowboys offered just that, trash advice.

Journalist Caroline Hunter’s comments seem consistent with well-researched factual evidence although she forgot to include Danske Bank, Landsbanki and a few others.

In any event, good to see that prominent journalists got involved in the matter as they are always keen to revisit a story they wrote about previously.

CAG’s (Costa Action Group) imput very valuable indeed.

26th May 2010: Luxembourg’s Jhon Mortensen says:

We have always encouraged clients to do wealth planning and save tax if they could, but always in a legal manner. Now we demand that you can convince us that you are paying tax, if you want to open an account here. It is now purely an onshore model.

26th may 2006: Nordea Luxembourg Jhon Mortensen says:

Borrowers may take up a mortgage loan either at the time of purchase of a Spanish property or after having owned the property for some time. While both possibilities exist, the latter case is more aggresive from a tax point of view and therefore, more uncertain.

According to the information the authors had at the time of writing, taking up a mortgage at a later stage was still expected to be accepted by the Spanish authorities in future.

Generally speaking, the risk of receiving unwelcome enquiries from the Spanish taxman should only exist in situations where the owner is a non-resident who takes up a mortgage loan with the aim of trying to minimize his/her net wealth tax liability.

Message to Mr. Mortensen: you just don’t have a clue on taxes, let alone Spanish. Taking up mortgages to make people, and the Tax Office, think that your property is worth less is like drawing cash from your current account and hiding it under your matress. If we know it and Mr. Thor Möger Pedersen knows it too, then you should know it, don´t you think?

Your publicity is fraudulent and encourages tax evasion, but you have chosen to cruelly perpetuate this deceipt on mostly vulnerable British expats who trusted your company, Nordea Bank Luxembourg.

Colin McCready, Equity Release travelling salesman and author of the scaremongering piece, was adamant of the risks of not taking up the

Jyske Bank Gibraltar product and set out to help his clients avoid the horrors of Spain’s tax system.

Jyske Bank Gibraltar product and set out to help his clients avoid the horrors of Spain’s tax system.

It is interesting to note that the most of those involved, save for one or two, will always resort to the fallacious “risks were fully disclosed“. Yes, they were obviously disclosed, as one can read on the attached document…

You just cannot find an ounce of honour, loyalty or pride in these cowboys.

We have just recently learnt of a whistleblower that got a $104 million payout for providing insider information on a scheme

run by UBS, Switzerland’s largest bank, that was devised to help rich Americans evade taxes. The US authorities, with their legendary efficiency when dealing with attacks on their country, dealt with the matter promptly. If one reads this formidable piece of legal work we can only marvel at the efficiency displayed by the IRS and the SEC against a bank that was accused, principally, of facilitating tax evasion by U.S. citizens.

run by UBS, Switzerland’s largest bank, that was devised to help rich Americans evade taxes. The US authorities, with their legendary efficiency when dealing with attacks on their country, dealt with the matter promptly. If one reads this formidable piece of legal work we can only marvel at the efficiency displayed by the IRS and the SEC against a bank that was accused, principally, of facilitating tax evasion by U.S. citizens.

Now if one is acquainted with the Spanish Equity Release Fraud, sold under different denominations but nothing short of a scheme devised by a number of Danish and UK banks, in collaboration with a selection of co-conspirators (unregulated unqualified IFAs) operating illegally in Spain, to cheat British expats on the main, as well as the Spanish Tax Office, we can draw very interesting parallelisms between both.

Here are some of the finding of the Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS):

“…The United States charges that UBS, through certain private bankers and managers in the US cross-border-business, participated in a scheme to defraud the US and its agency, the IRS, by actively assisting or otherwise facilitating a number of U S individual taxpayers in establishing accounts at UBS in a manner designed to conceal beneficial owners…

“…It was further part of the conspiracy that Managers, Desk Heads and Bankers assisted US clients in preparing IRS forms that falsely and fraudulently stated that nominee offshore structures, and not the US clients, were the beneficial owners of offshore bank and financial accounts maintained in foreign countries, including accounts in Switzerland and the UBS.

“…UBS did not generally refrain from conducting banking operations within the United States. UBS Swiss bankers targeted U.S. clients, traveled across the country in search of wealthy individuals, and aggressively marketed their services to U.S. taxpayers who might otherwise never have opened Swiss accounts. UBS practices resulted in its U.S. clients maintaining undeclared Swiss accounts that collectively held billions of dollars in assets that were not disclosed to the IRS.

The Government recognizes that UBS has previously announced that it will exit the United States cross-border business…

And here are examples of what some banks did, mirroring UBS’ awful behaviour:

Sydbank (Schweiz) ran an unauthorized office in Fuengirola wherefrom clients were contacted. After it was closed down, the managers, namely Mads S. Petersen, would travel to Spain to sign up new British customers, registering mortgage loans, in cooperation with Nykredit A/S, against their Spanish properties, after which Sydbank would destine the proceeds o to Belize-registered companies, whose ultimate beneficiaries were the real owners of the properties in Spain.

Danske Bank Luxembourg Branch, led by Morten Runo Waaben, John Lundskov Larsen and others are currently indicted in a criminal case for defrauding a British expat by falsely representing an illegal tax evasion scheme as a legal tax optimization tool, consisting in mortgaging a home to reduce the perceived value of it with a view to consequently file a reduced wealth and inheritance tax return. Their website has eliminated any trace of tax evasion propositions.

Nordea Bank Luxembourg branch, led by Jesper Hertz, Anders Bergmann and Michel Woidemann, all indicted in a criminal case for defrauding a British couple by providing them with fraudulent advertising, detailed their tax evasion plan in several brochures that minutely explained the processes employed by their company to reduce or eliminate Spanish Wealth Tax and Inheritance Taxes. A brazen Nordea even reflects on the risks of the Spanish Tax man challenging the scheme…Such brochures were later withdrawn from public circulation.

Sparekassen Lolland (former Finansbanken) executives, namely Michael Beck Christensen and Pernille Bering , would travel to Spain, from Denmark, to meet their clients, for the first and only time the day before granting artificial mortgage loans worth up to €3m to unsophisticated investors and investing the funds away from the Spanish Tax Office.

Claire Whittet from NM Rothschild & Sons, who have repeatedly declared that they were only the lender, in spite of brochures like the NMR Dispatch Spring2005 where it is clear they were also providing financial advice, has been commissioned to travel to Spain to meet with disgruntled clients, all of whom face losing their homes after signing up a fraudulent product that was sold by Mark Countach and Steve Dewsnip as follows:

“…Far too many expatriates find out the hard way that inheritance tax (IHT) does not work the same way in Spain…” “…the answer is to minimize the amount of assets that are exposed to this…the extreme rate of Spanish IHT is 81.60%…” “…a mortgage is a very effective way of reducing the total value of your Spanish estate to IHT…”

And also: …A Non-Tax Resident, owning a Spanish property, would legally register a charge against the property and invest the proceeds of the loan into the Capital Plus Protected Fund Euro Series…Monies Invested would stay out of Spain…legally no need to declare investment to Spanish Tax authorities”

Peter Rose, Managing Director for NM Rothschild & Sons, had no qualms in affirming that “…when buying property in Spain, you should make sure that you don’t get burnt by unexpected tax consequences…” To this effect, he develops a textbook tax evasion proposition that talks about “…the dream, the nightmare and the antidote“, the latter being the core sales pitch for the CreditSelect 4 Series product.

They ALL now deny liability…but brochures that remain buried in old files held by their victims are testament to the wrongdoing and of course, www.waybackmachine.org will grass them all up if they had compromising online brochures.

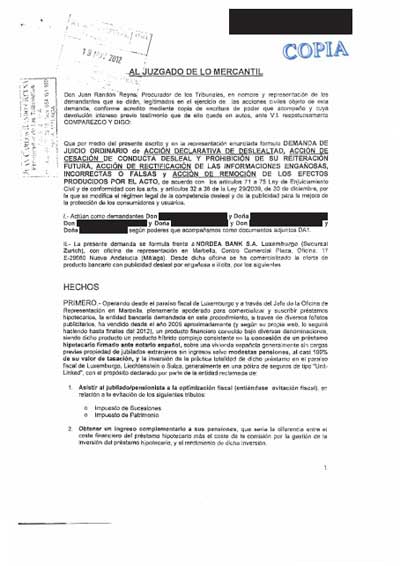

Six Erva.es associates have just launched a claim against Nordea Bank Luxembourg for misleading advertising, pursuant to the 2009 Unfair Competition and Publicity Act.

Anyone interested what the Act says can access a summary of it offered by a top UK law firm, or the contents of it, as published by the number 1 law firm in Spain (and who incidentally happens to represent one of the Equity Release banks, one which is willing to negotiate though).

And anyone curious to know which advertising is considered misleading can go to the Exhibits section of the writ, where a coloured full-copy of the law-infringing brochures are displayed.

The message Nordea put out to people was clear: if you have property in Spain and don’t have a mortgage registered against it, you are endangering the future of the generations to come. On the contrary, if you take out a mortgage loan and invest it with Nordea Luxembourg, you will enjoy the life of Riley, just as the Nordea satisfied family placidly enjoying a catch up and a picnic day out.

So much for the Nordic Values…that differentiate Nordea from their competitors.

Nordea Bank Luxembourg has persistently excused itself from any wrongdoing by stating that, although they do not confirm nor deny that abundant Equity Release advertising misrepresents the truth, “…ultimately, it was the choice of the consumer to rely on the representations made, or not, having been previously warned that they should seek independent advice.”

persistently excused itself from any wrongdoing by stating that, although they do not confirm nor deny that abundant Equity Release advertising misrepresents the truth, “…ultimately, it was the choice of the consumer to rely on the representations made, or not, having been previously warned that they should seek independent advice.”

This is like British Airways or P&O Ferries saying that, although they promise that they will carry a British family safely from Spain to England, the ultimate choice of travelling with them lies with the consumer and therefore, if the plane falls out of the sky over San Sebastian or the ferry sinks in the Gulf of Biscay, there is no such thing as compensable lack of air or seaworthiness because you should have brought in your mechanic to look out for faulty turbines or pistons, rusty rivets, low oil levels etc.

Or that if go to McDonalds and the meat tucked into your burger you thought was beef just happens to belong to a rodent, there is clearly no responsibility on their part because “ultimately it was your decision to attend the fast-food chain, or not”.

So it is the ever-widening gap between who they really are and who they wished they were that is forcing Nordea Luxembourg to resort to self-deceptive excuses to carry on.

And baffling as it may be, whilst they avidly foreclose on victims’ properties throughout the Spanish geography with Nordic efficiency after cheating them, Nordea Office Luxembourg is still offering a second to none tax-evasion booklet to British expats.

You are now warned: don’t leave it till the last minute and order your Nordea Luxembourg Inheritance Tax Manual for Spain today!