Jyske Bank Gibraltar is one of those financial entities that we can say has been, for some time now, sailing a little too close to the wind.

The latest scandal in the making is the proposed eviction of a Spanish resident lady, called Anne (pictured), who somehow managed to become eligible for a loan of €550,000 after presenting her credentials to the bank: survivor of several cancer operations (the last one 2 months prior), jobless, resident of Spain, never registered with the Social Security and with a meager €150/week pension from Belgium.

This form of predatory lending is certainly unknown in Spain where mortgage scandals generally relate to 120% loan-to-value mortgages, abnormal assessment of debt-to-income ratios of borrowers and other similar excesses.

Jyske has done that and more: they have lent where there was absolutely no physical possibility to repay (so much so that the Anne could not even cover the first repayment), have used an illegal company in Spain to assess its value (i.e. not registered with the bank of Spain) and moreover, have been happy with a valuation on the property next door because they could not find keys to the one transacted! Such a display of Nordic efficiency so that they could give out €550,000, seemingly in desperation to lend, to a convalescing jobless 62-year old lady (66 now) who already owned her little apartment outright -mortgage free-, and who thanks to Jyske would enjoy the benefits of a 35 year repayment plan (last repayment when she reached 97).

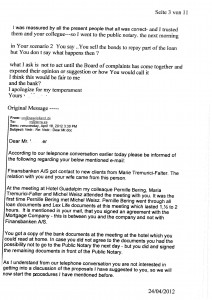

When Anne’s ex-husband found out what Jyske, and his ex too (!), were up to, he tried to prevent the mortgage loan from being signed by addressing a letter to Mr. Christian Bjorlow, Jyske’s Managing Director at the time of the infamous event, who rhetorically (or rather sarcastically we would add) responded by manifesting, in obvious incoherence with the financial status of the borrower, that:

“No responsible lender should grant a loan unless it reasonably believes the borrower has the ability to repay it…after carefully considering the facts along with the supporting documentation available to me, I am of the opinion that the bank has acted with due care and attention to this matter and consequently, I am unable to withhold your claim.”

Luckily, the Spanish Government yesterday passed a law stopping dangerously immoral people like Bjorlow from evicting vulnerable people like Anne.

Jyske’s historic relationship with Spain has traditionally been bumpy, to say the least. In 1994, they closed their Spanish branch for reasons we do not know. In 1999, they re-opened the branch with a view to serve the diverse expat communities investing heavily in Spanish property only to order its closure again in 2007, so that they could operate from the safety of Gibraltar it appears (cross-border service), and on the 26th of April 2010 they were fined by the Bank of Spain with 1, 7 million Euros for failing to comply with Spanish anti-money laundering provisions.

A while before, in 2004, the Supreme Court ruled against them by upholding a Court of Appeal ruling that ordered Jyske to pay an ex-employee compensation (€70,000), whose loan had been wrongly foreclosed because, even though it was agreed that whilst he worked for bank he would enjoy special terms and conditions, failing to pay higher interest when he left was not agreed as a “foreclosureable” default. As it happened, he had opted for a job with another bank which, clearly, was not of the liking of the bank. According to the Court, Jyske was found “…lacking good faith when exercising its rights under the mortgage loan contract”.

And not that long ago either, the Malaga Court of Appeal ruled that Jyske was not the owner of a company, Valiant Holdings, whose shares were pledged in guarantee of a loan repayment on a Spanish property. In spite of this, they chose to flatten the gardens, cut out the windows and close them up with wooden planks.

Last year, the Olive Press stepped in to help a victim of rogue trading and as recently as the 4th of October 2012, the Advocate General issued an opinion to the European Court of Justice, as requested by the Supreme Court on occasion of the appeal filed by Jyske Bank Gibraltar to the imposition of the 1, 7 million fine, to the extent that Spain has the right to exercise its right to supervise any bank operating in Spain, in respect of anti-money laundering provisions and any other matters of public interest, regardless of whether they are, or not, operating via a branch.

And we would not like to finish this post without a reference to what is going to be the very latest scandal to soon hit the headlines: the Equity Release tax-evasion fraud perpetrated by Jyske Bank Gibraltar.

Strategic Asset Allocation was the pompous description coined by FINANSBANKEN A/S, taken over by Sparekassen Lolloland, to encapsulate a deceitful equity release product.

Strategic Asset Allocation was the pompous description coined by FINANSBANKEN A/S, taken over by Sparekassen Lolloland, to encapsulate a deceitful equity release product.