An employee of a Bankia bank branch has confirmed to the Judge that he had no understanding of the financial product he was selling to a pensioner. What he did tell his client though was that Bankia would soon be topping the lists of the most important banks in Spain: as it happened, it went bust and was bailed out.

Pernille Bering, pictured below, was responsible of signing off the largest ever Equity Release tax-evading product to a Spanish property owner (circa €3 mm) when she worked for Finansbanken. Unlike the Bankia simpleton above, we resist cynicism and continue to believe that she was just not a pretty face sent overseas to charge unencumbered homes owned by pensioners with huge mortgages, but a discernibly intelligent person with a conscience.

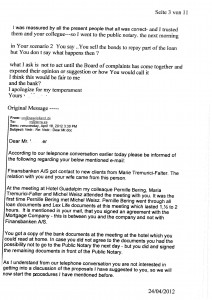

But Pernille let everyone down: desperate to get ahead in her carreer but unwilling to get her hands dirty, she employed a locally based housewife, Maria Tremurici-Falter, to sell to unwarned Costa del Sol pensioners millions of Euros worth of Finansbanken Strategic Asset Allocation Revolving Credit Agreements to purchase investment grade bonds (with a rating not lower than BBB- By Standard & Poor), with a special taste for participations or constributions in non-leveraged hedge funds.

Busy with appointments with her local beauty salon to have her toenails done, Maria could still spare some time to loyally fulfil the Finansbanken Equity Release Sales Programme that consisted on the following:

– Maria would advertise on locals papers on a miraculous way to avoid the horrific consequences of Spanish IHT (thankfully, we now know that the correct word is evade).

– María would explain to panic-stricken pensioners that, with her recipe, they would be alright.

– Pernille would review potential customers’ income documentation (provided she could find any that is) and, the day before signing millions of Euros worth of fraudulent Strategic Asset Allocation at the Notary Office, she would fly down from Denmark for a quick afternoon sum-up meeting with the client at the NH Hotel, or Guadalpin, meetings that generally lasted 45 minutes.

– Next morning, execution-day, the client would be led to the Notary Office to crystalize the fraud.

It is believed that Finansbanken, later called SparLolland and later taken over by Jyske Bank, sold a total of 20 million worth of Equity Release in Spain.