Julia Hilling is making a quick recovery at the Costa del Sol Hospital after suffering a hip fracture.

Julia Hilling is making a quick recovery at the Costa del Sol Hospital after suffering a hip fracture.

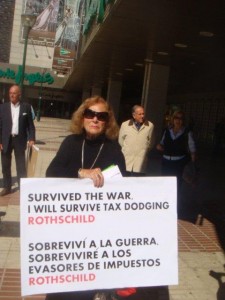

We hope that she is soon out to continue the fight against Rothschild.

“Do not lie down but stand up and fight them!"

Nordea Bank Luxembourg must feature top of the list in this imaginary list of indecent foreign banks that once operated, and still do, in Spain. From a tiny office in Marbella, Centro Plaza, they have scammed untold numbers of otherwise happy British (and probably many fellow-nationals) property owners.

This booklet will soon be studied by investigators in tax evasion criminality, scholars and Universities of all over Europe. Across the Atlantic, the US Attorney’s Office in Manhattan is being sent a full dossier of the incriminating paperwork for their consideration, as it appears that Nordea Bank Luxembourg also felt the need to cheat the US Internal Revenue Service.

Rothschild and Landsbanki have packed up, knowing the extent of the damage.

Judicial action will soon catch up with these banks.

A great anonymous piece that explains how it all happened.

It could have not been written better by Rothschild.

If Inheritance Tax savings was not enough enticement -or more accurately, as Steve Dewsnip tells us, it would save your home from the predatory Spanish Taxman– , the perfomance of the deal was presented as being so good that you would end up having that extra generous income by putting “your bricks to work for you” (Allan Graydon).

The attached is a brutally misleading illustration that, additionally, omits any reference to adverse market movements.

But the banks rationale was different: why would you want to put your customers off buying into the product if it was working for the bank? At the end of the day, if it all went tits up banks would argue that the customers could and should have “gone elsewhere to get accurate advice” (Nordea Bank Ipse dixit).

Rumour has it that for someone somewhere in the mountains of South Cordoba…it did actually work for a few months. The ERVA investigations teams are keen to meet this endangered specie…

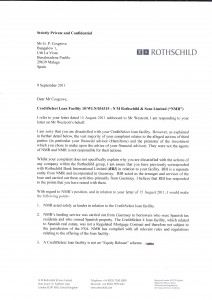

(the attached was given to a Rothschild customer).

Such a worrying discrepancy could not go unanswered and consequently, Erva lawyers have now written to top-firm Uría & Menéndez for an explanation. It does not take a great capacity of comprehension to understand that the “offending” paragraph would have met great resistance from the instigators of Rothschild’s CredictSelect Loan Facility, a fundamentally flawed, predatory and deceitful product.

Such a worrying discrepancy could not go unanswered and consequently, Erva lawyers have now written to top-firm Uría & Menéndez for an explanation. It does not take a great capacity of comprehension to understand that the “offending” paragraph would have met great resistance from the instigators of Rothschild’s CredictSelect Loan Facility, a fundamentally flawed, predatory and deceitful product.

As Rothschild put it, an asset backed loan that is unlike a conventional mortgage (sic).

The below statement has been made by an Hamilton’s ex-employee who has confirmed his willingness to cooperate in a potential Court case against Rothschild.

For legal reasons, his name and other personal circumstances have been removed.

It’s credibility can be proven by reference to other almost identical statements, promotional literature and other means of proof;there is total consistency in the “modus operandi”, names, premises on which the product was sold, alibis used by the bank to attempt to excuse any liability etc.

In 2002 moved to Spain.

We bought a home in Estepona and took a couple of months to settle in.

I responded to an advert in the SUR in English, for FPC ( Financial Planning Certificate) qualified advisers for Hamiltons based in La Cala de Mijas. I contacted Hamiltons and met with the owner Dean Murphy and the manager Peter Hardy.

The interview went well with the two individuals extolling the virtues of an IHT avoidance scheme funded by Rothschilds and the Premier Investment Company based in the Isle of Man.

The basics were simply a debt in the form of a mortgage with Rothschilds was created to mitigate the amount of any inheritance on death of the property owner. Any beneficiary would inherit the value of the asset less any debts and therefore reduce any IHT demand, which was said to be very onerous in Spain.

The mortgage funds would be placed in an offshore investment fund out of the reach of the Spanish Tax authorities. The fund had an historic performance well in excess of the mortgage charge rate, so technically the investment return paid the mortgage and any surplus growth would be added to the fund or the borrower could draw down any surplus to supplement income.

This was not a new Rothschilds scheme, the product has been in the Rothschilds portfolio for many years, there is mention of this scheme all over the internet dating back years.

I was offered a job and required to attend a training session, which was attended by Steve Dewsnip Director Rothschilds Guernsey and Charles Walton Premier Fund managers IOM.

During this meeting I became aware from statements made that the scheme had been put together by Charles Walton the fund manager with Premier (who subsequently became the fund manager for all the other funds which followed the switch from premier to the many other funds, none of which made the returns quoted to clients)

Charles Walton was a long time friend of Dean Murphy.

Dean had worked in Dubai where he operated an investment company serving ex pats who lived and worked in the tax free environment of Dubai. During this time he had met Charles Walton.

I was informed that the IHT scheme had been put together by Charles Walton and he had approached Rothschilds as a funder along with Surrendalink Mortgages as an alternate funder.

Charles Walton explained the scheme in detail, how the money was relased from the property by way of a mortgage and the funds would then be invested offshore outside the reach of Hacienda.

THE CLIENT HAD NO CHOICE REGARDING THE INVESTMENT FUND. THE FUND WAS VETTED AND APPROVED BY ROTHSCHILDS AND THE LOAN WOULD ONLY BE GRANTED ON THE STRICT UNDERSTANDING THAT THE FUNDS WOULD BE INVESTED WITH THE FUND DICTATED BY ROTHSCHILDS.

We were never given a choice of funds to pass on to clients.

When the fund was changed due to poor performance, we could not sell the new fund until Rothschilds had approved the fund. HOW CAN THEY SUBSEQUENTLY CLAIM THEY DID NOT GIVE INVESTMENT ADVICE……………ABSOLUTE RUBBISH, THEY DICTATED THE FUND FROM THE OUTSET.

My argument has always been that the funds were placed into experienced investor accounts in the Isle of Man, with no regard to the clients knowledge of experienced investor funds.

Steve dewsnip then took over the meeting extolling the history of Rothschilds and the fact that they had survived on reputation and would not do anything to tarnish that reputation of the bank. We would never read the headline “Rothschilds evicts Spanish resident”, it just would not happen.

There were at least 10 people in the training room who heard this statement, in my case I attended 3 meetings with Steve Dewsnip/ Charlie Walton where this statement was made.

I will also state for the record that whilst there was several members of the sales force who were financial services experienced and qualified in the UK, there were other sales people who had no experience in Financial Services experience who were trained in house on this product.

The scheme seemed genuine and was supported by opinions from Ernst & Young in Madrid and Uria & Menendez, Abogados in Madrid.

We were given point of sale material which included these opinions all given to support the scheme.

We were given qualified appointments, met with clients in ther home, instructed them of the IHT liability in the event of death, informed them of the scheme to mitigate IHT, signed them up and handed the paperwork into Hamiltons who sent it off to Rothschilds.

Once approved we were required to meet with the clients and convey them to the lawyers in Malaga, lawyers appointed by Rothschilds, the client was given no choice ( this would not be allowed in the UK) The Notary would attend the lawyers office and Notarize the loan documents.

The clients never saw any money it went from the bank straight into the investment fund.

The issue in every case was the poor performance of the investment fund. With one poor choice being followed by another then another then another, none of which were in the clients control. Every time the fund crashed Hamiltons sought leave of Rothschilds to switch the fund.

In the UK if you move a fund, you are paid a commission, I would think Hamiltons were earning commission time after time, switch after switch.

If the funds had performed we would not now be talking. I have always maintained that the way to the table with Rothschilds is to pursue the Investment advice route.

Barclays Bank were recently fined £30 million and ordered to compensate all investors who took advice on a Barclays nominated fund that had an elevated element of risk, when the client were risk averse.

The clients could only invest where Rothschilds dictated, they nominated the fund, approved the fund, they must be liable for the fund performance and the current situation culminating in repossession.

This is a true statement, let me know if you require any further information

Regards

We welcome any further ex-Hamiltons or Ex-Henry Woods sales reps to come forward with a statement, each of which represents a nail in the coffin for the Equity Release obnoxious products.

Can we really add anything to this?

No, not really, it speaks for itself!

ERVA seems to have a fixation with Rothschilds when it comes to exposing the cheek and skullduggery of bankers, but this is not the case; it is rather that this sadistic and innately sinister corporation, intent on perpetuating stress-related ailments on people who were otherwise perfectly healthy -financially too- can hardly raise any sympathies.

Victims of this company’s plan to deceive expats generally express a familiar emotional pattern, when talking about this scheme: their worries quickly dissipate and give way to anger and fury, more so when they find out, to their horror, the pack of lies they were subjected to.

In 2012, Rothschild is saying this:

Hamiltons were your financial adviser and acted as your agent in relation to your application for a CreditSelect loan facility, we are not able to accept responsibility for any advice that may have been given to you by Hamiltons.

But in 2006, Rothschild was saying this:

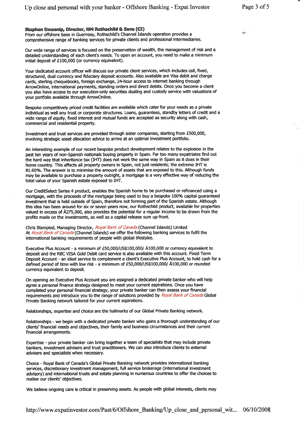

Our innovative product CreditSelect is available throughout a network of financial advisers around the world, thus giving clients straightforward access to credit for a while range of purposes…”

To Help Support those professional financial advisory firms with whom we have agreed terms of business for the availability of CreditSelect, we have a website dedicated to assisting the promotion and delivery of the service…”

This website is regularly updated to ensure that our introducers have round the clock access to all facility documents for downloading and printing…clients brochures, the latest Funds List…”

Our product CreditSelect has been so successful that we have restricted its availability to a handful of quality introducing intermediaries”

Mr. Mark Countanche and Mr. Peter Rose, a piece of advice: your compulsive lying is going to take you nowhere, given the crystal-clear evidence of paper trail you have left behind, not to mention that you actually taught, trained, coached and instructed Hamiltons Financial Services, Henry Woods Investment Managements and others, accordingly.

Change your strategy, change your lawyers and do it fast. Oh, and avoid “unworthy of trust” firms that are just clocking up hours regardless of the quality of the advice they are giving, being with the “largest firm” will just not help you.

One thing Julia found most upsetting was the fact that she is of Jewish descent, just like Rothschild are reported to be, in spite of which she was taken in by her coreligionists with false promises of Inheritance Tax benefits and regular income. The Daily Mail covered her story and yet, Rothschild deny any wrongdoing. They are currently basi ng their legal defence on 2 items:

ng their legal defence on 2 items:

By employing two full-time credit analysts within our Banking Team dedicated to researching and analysing offshore mutual funds, we are able to accept a wide range of investments provided by major fund management groups as collateral for CreditSelect Loans.

CreditSelect has been so well received that we have had to restrict its availability to just a handful of quality introducing intermediaries throughout the world.NMR DISPATCH AUTUMN 2001

Members of the ERVA are to file a group action against Rothschild for misleading publicity, in respect of the Equity Release, at the provincial Mercantile Courts of location of the property affected.

Members of the ERVA are to file a group action against Rothschild for misleading publicity, in respect of the Equity Release, at the provincial Mercantile Courts of location of the property affected.

Legal grounds for bringing such an action are 2, mainly:

The claim, which is to follow the same format as the Nordea Claim, is to be filed on the 20th of December 2012.

Other than that, we would not wish to miss this opportunity to briefly comment on the attached information, one of many examples of abundant tax-evading publicity that Rothschild produced.

A calm and unflustered Steve Dewsnip, a prominent Rothschild figure when the scheme was going strong on the Coasts who is currently doing other things, spoke and wrote like a Spanish Inheritance Tax expert. Far from it, the man was just clueless.

But the worse we think was the use of an unsettling word, “bespoke”, to ill-define the nature of this absolutely commoditized deceiptfully predatory product sold to pensioners, without distinction and without, of course, any semblance to the meaning of it.