admin

This user hasn't shared any biographical information

“Do not lie down but stand up and fight them!"

Equity Release for UK Home Owners was also publicized for Inheritance Tax mitigation purposes, supposedly in compliance with English tax laws on the matter. But was it also a time-bomb, like the Spanish devious taxman depicted is openly warning us all?

How come no Spanish bank ever offered such a revolutionary product to national taxpayers?

Did they know something the very clever Luxembourg-based Scandinavians milking hard-working Spanish-based British expats missed?

Were Spanish banks so inept at marketing that Rothschild had to fly out to teach them a few things on successful new-product launching?

Documents

The farcical testimonials are testament to the immense deceit rained on unsuspecting punters. We just wonder what happened to them…

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

What are the implications of this conclusion for the banks?

In principle, the consequences can vary enormously depending on whether banks misrepresented their clients by making them believe that they could mitigate taxes legally, when this is untrue, and this can be proven in a court of law. Where proven, the contracts can be declared void and the bank forced to lift the mortgage on the property, and by application of article 1.306 of the Civil Code, be prevented from claiming the draw downs.

Banks that have assisted inheritors in collecting life assurance/insurance payments on death of the policy holder, without demanding that taxes were paid, can become “substitute taxpayers” and end up footing the bill. Where the owed tax exceeds €120,000, this could constitute a crime under the Spanish Penal Code, punishable with prison terms.

And for property owners?

Taxpayers may have effectively mitigated taxes by declaring the charge to represent a “true” debt, in the belief that they were doing the right thing. The right of the Tax Office to demand unpaid taxes are not compromised by virtue of agreements between the cheating banks and their victims and so, they can pursue taxpayers.

One thing is now clearer: property owners are now in a far better position to pursue the declaration of voidness/nullity of the equity release agreement, as a single juridical contract, given the gross misrepresentations by banks, and their agents, when selling this fraudulent product.

Documents

The Spanish Tax Office has finally ruled on the validity of using mortgage loans to avoid wealth and inheritance taxes.

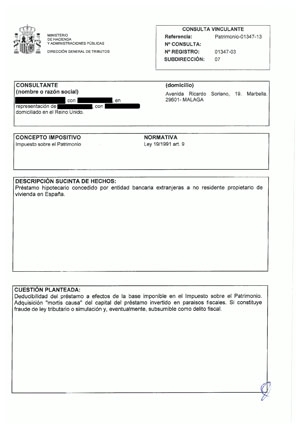

ERVA will post the original binding consultation letter, named as CONSULTA VINCULANTE Patrimonio -01347-13, in the next couple of days.

Meanwhile, this is what they had to say about this dodgy set up:

Further to the above, we received a clarification email stating the following:

Email sent to ERVA:

From: S.G. de Impuestos Patrimoniales, Tasas y Precios Públicos

Sent: miércoles, 06 de marzo de 2013 12:26

To: Fatima Izquierdo

Subject: RV: A/A D. José Javier Pérez-Fadón Martínez_Consulta vinculante_Patrimonio 01347-13

Estimada Sra. Izquierdo: La contestación V0590-13, fechada el 25 de febrero pasado, establece la no deducibilidad en la base imponible del Impuesto sobre el Patrimonio, para supuestos de obligación real de contribuir, del préstamo hipotecario extranjero en cuanto no es carga o gravamen de la vivienda, sino deuda. En el ámbito del Impuesto sobre Sucesiones y Donaciones y para la misma hipótesis de obligación real de contribuir, como decíamos en la mencionada contestación, el causahabiente no tributará por el capital del préstamo y, como es lógico y resulta de no tratarse de carga o gravamen sobre la misma, tampoco podrá minorar el valor de la adquisición de dicha vivienda en el importe del préstamo.

Confío en que quede así aclarada la cuestión planteada.

Saludos.

Javier Pérez-Fadón Martínez.

Subdirector General de Impuestos Patrimoniales, Tasas y Precios Públicos.

Finally, we have requested from the Tax Office that the email below is incorporated to a binding letter.

Unlike Nordea Bank Luxembourg, Unicaja is sending letters out to the beneficiary of a life insurance policy requesting proof that an IHT form was returned to the Spanish Tax Office, prior to releasing the funds. The bank even specifies the sum of money that needs to be declared and the appropriate box in the form, and they will not release any payments under life insurance policies until this is verified.

Unlike Nordea Bank Luxembourg, Unicaja is sending letters out to the beneficiary of a life insurance policy requesting proof that an IHT form was returned to the Spanish Tax Office, prior to releasing the funds. The bank even specifies the sum of money that needs to be declared and the appropriate box in the form, and they will not release any payments under life insurance policies until this is verified.

Most of the banks are using the “limitation of liability” clause to argue that, whilst “every endeavour has been made to ensure the accuracy of the information provide, we cannot take any responsibility for losses sustained as a result of relying total or partially on it”.

This dishonest clause, an indipensable tool in the sales kit of any dishonest business operator worth his salt, was for example used by Nordea Bank Luxembourg S.A. to say that although loads of tax advice was given, they can never be held responsible for it.

But then, article 130 of the Consumer Protection Act states the following:

Inefficacy of limitation or exoneration of liability clauses: clauses limiting or exonerating from responsibility in respect of instances of civil responsibility under this Act are not applicable and thus, inefficacious.

See what NORDEA says about their booklet:

inheritance – the available possibilities of ensuring that your descendants prosper;

life assurance may be the optimal way to mitigate the impact of inheritance tax.

This, and more, in 2013 and for Spain.

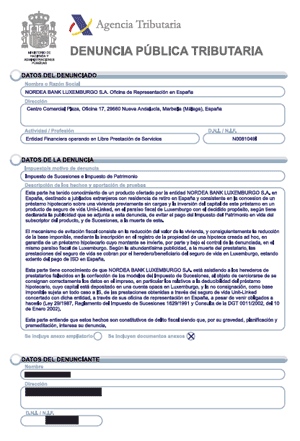

Having been made aware that NORDEA BANK LUXEMBOURG may be assisting inheritors on the delicate issue of filing IHT returns in respect of deceased subscribers of the tax-evading Nordea Mortgage + Unit Linked Policy package, it was deemed convenient to report this to the Spanish Tax Office.

Having been made aware that NORDEA BANK LUXEMBOURG may be assisting inheritors on the delicate issue of filing IHT returns in respect of deceased subscribers of the tax-evading Nordea Mortgage + Unit Linked Policy package, it was deemed convenient to report this to the Spanish Tax Office.

The “denuncia” informs the authorities that NORDEA Bank Luxembourg S.A. could be advising inheritors on how to fraudulently register the mortgage loan in the tax form, as a real debt, also fraudulently leaving out the value of the unit-linked policy altogether, even though the sums obtained by the inheritors are fully taxable in Spain whether the inheritor is a resident, or not, contrary to Nordea’s publicity.

Tax Fraud is a crime prosecutable in Spain where the sums defrauded exceed €120,000.

A unit-Linked policy worth €500,000 inherited “abroad” and not declared in Spain, that is, with the assistance of Nordea’s Jesper Hertz (Marbella) and Jhon Mortensen (Luxembourg), would defraud the Spanish Tax Office €125,805.34…

Nordea Bank Luxembourg must feature top of the list in this imaginary list of indecent foreign banks that once operated, and still do, in Spain. From a tiny office in Marbella, Centro Plaza, they have scammed untold numbers of otherwise happy British (and probably many fellow-nationals) property owners.

This booklet will soon be studied by investigators in tax evasion criminality, scholars and Universities of all over Europe. Across the Atlantic, the US Attorney’s Office in Manhattan is being sent a full dossier of the incriminating paperwork for their consideration, as it appears that Nordea Bank Luxembourg also felt the need to cheat the US Internal Revenue Service.

Rothschild and Landsbanki have packed up, knowing the extent of the damage.

Judicial action will soon catch up with these banks.