admin

This user hasn't shared any biographical information

“Do not lie down but stand up and fight them!"

Nordea Bank S.A. lawyers use the tactics that you would expect to find in what is called a Rambo lawyer. They will try to distract the Courts with various underhanded moves and confuse them, attempting to win at any cost even if it is at the expense of the credibility of their own client.

Let us explain further: Nordea Bank S.A. Luxembourg operates in Spain via its Marbella office, run by podgy Jesper Hertz. Some of the contracts that Nordea Bank S.A. signed with their very unfortunate clients were done so by the Luxembourg based Nordea, which is an S.A. (kind of plc), whereas others were by the company Nordea Bank S.A. Luxembourg, Zweigniederlassung Zürich, which their Swiss branch.

According to Nordea’s clever lawyers, the Swiss branch is a separate company altogether and is to be sued separately, as it has no connection with the Luxembourg parent company from where it has taken its name (we are sure of that, yeah, it was actually us who put them in touch with each other and that is why they now get on famously).

Well, some points to consider here when dealing with those Rambo lawyers’ antics:

– Nordea Bank S.A. Luxembourg, Zweigniederlassung Zürich is not authorized to operate in Spain, according to the Bank of Spain. So if it is not legally authorized, how come they offer banking products here?

– Nordea Bank S.A. Luxembourg, Zweigniederlassung Zürich uses Jesper Hertz to sign all of its contracts, as does its parent company. That surely must be a coincidence!

– Nordea Bank S.A. Luxembourg, Zweigniederlassung Zürich responds to clients’ letters through their Luxembourg office…strange?

– Nordea Bank S.A. Luxembourg, Zweigniederlassung Zürich responds to clients’ angry letters with letterheaded paper from their Luxembourg parent company…they must have run out of corporate stationery.

– Nordea Bank S.A. Luxembourg, Zweigniederlassung Zürich uses the same lawyers as the parent company, and also deals with clients through the Marbella branch, and also shares the website of the parent company in Luxembourg, and perhaps, after all, they are the one and only company…

But realistically, who is surprised by a banking conglomerate that invites people, with properties in Spain, through their prolific advertising offered from their Spanish branch office, to defraud the Spanish Tax Office?

We can today say that Danske Bank Luxembourg, operating from their offices in Centro Comercial Idea, Carretera Fuengirola Mijas, was definitely successful in spreading the story that taking out a mortgage on your home to avoid Spanish taxes was the best thing since sliced bread.

A great deal of the business carried out by Danske Bank in Spain was Equity Release though straight loans to purchase property were also signed.

However, judging by how many equity release contracts we have knowledge of, in so many different places in Spain, we can say Danske’s scaremongers managed to make their lie, no matter how outrageous, a truthful story by repeating it often enough.

Spanish online journal El Confidencial has today published an article on Nordea Strategic Asset Allocation, under the following heading:

PRESERVATION OF CAPITAL AND SUSTAINABLE RETURNS, WITH NORDEA

Sadly, little does the author know about the real predatory nature of this product, the careless and incompetent people that run it and the devious lawyers that protect it. Not to mention that, once you have been ripped-off, you will be told that Spanish regulators have no jurisdiction over Nordea activities in the country.

At ERVA, we think it is time to rename this product and have proposed the following:

Let us have your comments!

It has been discovered, with some distress we may add, that the much flaunted Court victory of a Landsbanki victim in 2011 had more to it than met the eye for, whilst the victim won a ruling in the First Instance declaring the mortgage loan and the investment contract void, the ruling was subsequently revoked entirely, on appeal, by the Málaga Appeal Court (ruling dated 18th February 2013).

In principle, not good news for pessimists but being practical, one can extract in interesting conclusions on how should a new claim be filed, what laws be invoked, the extreme importance of supporting evidence or even, the situation with Landsbanki’s bankruptcy. Below is a very sketchy summary of the case (a more comprehensive resume will follow):

– OMM was sued together with Landsbanki, but Lef Life was left out (even if their contract was attacked by the claimant’s legal representation).

– The claim was based heavily on mis-selling within a financial investment contract, as opposed to an Equity Release contract or even a mortgage loan but then, the party to the financial product -a Unit Linked Life Insurance Policy- was not sued jointly.

– Mentions were made to IHT benefits but apparently so, no evidence that this constituted fraud or, at the very least, not proven. The Court of Appeal in fact admits that the substance or essence of the contract is actually Tax Mitigation, and that there is no error there (!!!). More so, the Appeal Court does even go to name product, Spanish Inheritance Tax Reduction Arrangement (SITRA).

– The claim confused the mortgage loan contract with the investment portfolio contract, and it was not proven they were one single overall agreement with several contracts in it: the Malaga Appeal Court outlined this.

– The claim invoked the 47/2007 Securities Markets Act when it was not applicable at the time of the claimants signing their ER contract.

– The Appeal Court noted that there was a general lack of evidence in support of the claim, in particular to do with failing to prove that either defendant guaranteed the improbable fact that the investment yield would suffice to cover the mortgage repayments as well as,

On a side note, we must add that OMM came out victorious for 2 reasons: a) they were deemed as business introducers, nothing more and b) even if they were selling financial products, the Court found that life insurance unit-linked contracts were within their remit, considering they did have an insurance brokerage license.

The upside is that the Court of First Instance did find both defendants guilty of mis-selling which should make Landsbanki wonder what would happen if, for instance, a new claim was filed against them addressing all the above shortcomings/incorrections, as they were highlighted by the Appeal Court, in particular the position of the Spanish Tax Office.

In our opinion, the case should be revisited and the Court of Appeal shown that they have just endorsed, unknowingly, a tax evasion product…

The most influential Spanish online news site, El Confidencial has written a damning article about the dubious practices of Jyske Bank Gibraltar, in Spain.

The piece, clearly inspired -and acknowledged twice- by a post published on ERVA, questions the activities of Jyske Bank Gibraltar in Spain and reminds that the bank was recently fined 1,7 million Euros for refusing to disclose sensitive information demanded by Spanish authorities pursuant to anti-money laundering legislation.

The article considers Jyske Bank to be “suspicious” of acting in breach of Spanish tax and anti-money laundering provisions, just what Switzerland was accused of doing for years, but on a worldwide basis (only to finally budge under very serious pressure from the U.S.).

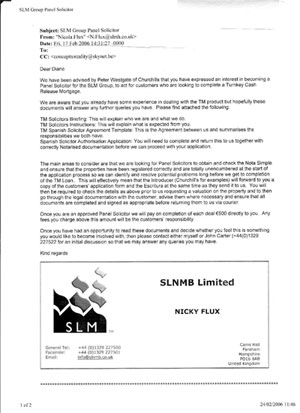

Interesting letter sent by Nicky Flux, from SLNMB, setting out the requirements to become one of their Panel Solicitors for representing them in signing up customers for their Turnkey Cash Release Mortgages. Alas, Nicky has forgotten to mention that they cannot operate in Spain because they have not duly applied for regulatory authorization!

Interesting letter sent by Nicky Flux, from SLNMB, setting out the requirements to become one of their Panel Solicitors for representing them in signing up customers for their Turnkey Cash Release Mortgages. Alas, Nicky has forgotten to mention that they cannot operate in Spain because they have not duly applied for regulatory authorization!

Nicky, you should have made your Panel Lawyers aware that your company furthered a type of banking “piracy” in Spain because your company robbed innocent people of their wealth and health, not to mention the implications of making peaceful British expats accomplices of a tax fraud scheme.

Oh, we forgot to add that €500 to represent your company for acting illegally in Spain is hardly a fair emolument, SLMB’s so tight that it squeaks!

An employee of a Bankia bank branch has confirmed to the Judge that he had no understanding of the financial product he was selling to a pensioner. What he did tell his client though was that Bankia would soon be topping the lists of the most important banks in Spain: as it happened, it went bust and was bailed out.

Pernille Bering, pictured below, was responsible of signing off the largest ever Equity Release tax-evading product to a Spanish property owner (circa €3 mm) when she worked for Finansbanken. Unlike the Bankia simpleton above, we resist cynicism and continue to believe that she was just not a pretty face sent overseas to charge unencumbered homes owned by pensioners with huge mortgages, but a discernibly intelligent person with a conscience.

But Pernille let everyone down: desperate to get ahead in her carreer but unwilling to get her hands dirty, she employed a locally based housewife, Maria Tremurici-Falter, to sell to unwarned Costa del Sol pensioners millions of Euros worth of Finansbanken Strategic Asset Allocation Revolving Credit Agreements to purchase investment grade bonds (with a rating not lower than BBB- By Standard & Poor), with a special taste for participations or constributions in non-leveraged hedge funds.

Busy with appointments with her local beauty salon to have her toenails done, Maria could still spare some time to loyally fulfil the Finansbanken Equity Release Sales Programme that consisted on the following:

– Maria would advertise on locals papers on a miraculous way to avoid the horrific consequences of Spanish IHT (thankfully, we now know that the correct word is evade).

– María would explain to panic-stricken pensioners that, with her recipe, they would be alright.

– Pernille would review potential customers’ income documentation (provided she could find any that is) and, the day before signing millions of Euros worth of fraudulent Strategic Asset Allocation at the Notary Office, she would fly down from Denmark for a quick afternoon sum-up meeting with the client at the NH Hotel, or Guadalpin, meetings that generally lasted 45 minutes.

– Next morning, execution-day, the client would be led to the Notary Office to crystalize the fraud.

It is believed that Finansbanken, later called SparLolland and later taken over by Jyske Bank, sold a total of 20 million worth of Equity Release in Spain.

As a result of the decision taken by 3 Magistrates of the Malaga Appeal Court to reject an appeal lodged by Danske Bank International S.A., the lender has been ordered to pay costs.

Danske Bank lawyers were insistent that their representatives were not summoned to Court. Both the Court of First of Instance and the Malaga Appeal Court thought otherwise.

It will now be interesting to find out where did Danske Bank get the brilliant idea of offering mortgages on Spanish property to artificially reduce its value for tax purposes because KPMG says they did not.

Can Klaus “Mønster” Pedersen please shed some light on this conundrum?

The Malaga Appeal Court has rejected a motion filed by Danske Bank lawyers attempting to revoke a decision by the Court of First Instance in Fuengirola that had ordered, some months back, to summon the Danish lender’s managers in their capacity as representatives of the “civilly responsible” party.

The importance of the decision lies with the position of the State Prosecutor Office for, whilst initially they had pressed for the whole Equity Release case to be dismissed (and so had the Fuengirola Judge), in respect to the above appeal their stance can be said to have taken a U-turn when they specifically opposed such appeal.

The bank’s representatives will now have to respond to the questions of the lawyers acting for the Equity Release victim E.A. such as, for example, why did they use the name of K.P.M.G. to convince customers to sign up for the Danske Bank Luxembourg Unit Link/Capital Assurance product when the consultancy mega-firm had never given their blessing to this tax evasion product.

ERVA would like to hire Mr. Shannon as their legal representative. He is a master of magic and can actually make you think that what you read is not really what you read, that what you understood is far from it (and of course, entirely the reader’s fault for being a twit) and that, on the whole, the advertising published by his bosses is fundamentally correct in what benefits them but, at Rothschild’s insistence, not to be relied upon on what it is detrimental.

ERVA would like to hire Mr. Shannon as their legal representative. He is a master of magic and can actually make you think that what you read is not really what you read, that what you understood is far from it (and of course, entirely the reader’s fault for being a twit) and that, on the whole, the advertising published by his bosses is fundamentally correct in what benefits them but, at Rothschild’s insistence, not to be relied upon on what it is detrimental.

But leaving that aside, is there a reason why Mr. Shannon has not included a mention to the associated spectacular tax savings that Mr. Steve Dewsnip promises time and time again in his articles, and which happens to be fundamentally inaccurate, incorrect, false and illegal?

Documents