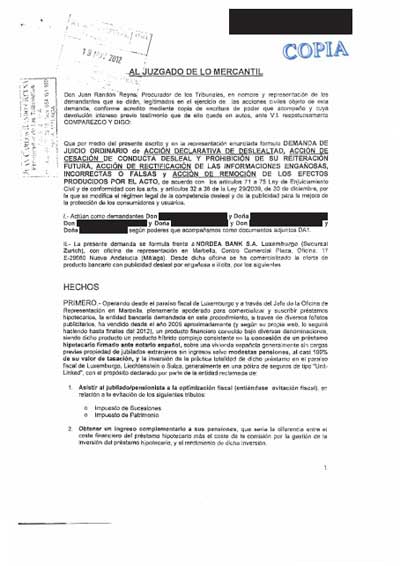

The attached picture corresponds to Mr. Jesus Pérez de la Cruz Oña, acting lawyer for Nordea

Bank Luxembourg S.A., nothing wrong with that. In fact, his austere expression conveys seriousness and rectitude, qualities that these days are in short supply.

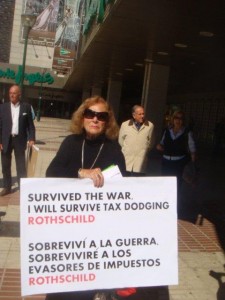

Mr. Pérez Cruz represents a company, Nordea Bank Luxembourg S.A., that produced what is probably the most comprehensive tax-evasion brochure ever to be published by any company, and perhaps the only bank to have done so, so far with little consequences for them. And he defends its content vigorously, for which he gets paid nicely, as a result of his swear-in ceremony, wherever it took place; again, nothing wrong with that.

Let’s remember what Nordea said:

Borrowers may take up a mortgage loan either at the time of the purchase of a Spanish property or after having owned the property for some time….the latter case is more aggresive from a tax point of view and therefore more uncertain…taking up a mortgage loan at a later stage runs the risk of the Spanish authorities questioning the purpose of the mortgage…as this publication was being prepared, mortgaging Spanish property some time after its original acquisition was a matter of some debate in Spain…according to the information the authors had at their disposal at the time of writing, taking up a mortgage at a later stage was still expected to be accepted by the Spanish authorities in future.

Generally speaking, the risk of receiving unwelcome enquiries from the Spanish taxman should only exist in situations where the owner is a non-resident who takes up a mortgage loan with the aim of trying to minimize his/her net wealth tax liability.

But one thing is not right: Mr. Perez Cruz says in his CV that he practiced for prestigious Uria & Menendez, a company that said about these products – before removing the paragraph following a phone call from Rothschild- the following:

It may not be discarded that the Spanish Authorities may try to challenge the deductibility of a loan granted to a non-resident for IHT purpose under the arguments that either (i) the debt has been “simulated” for the exclusive purpose of reducing the Spanish IHT liability or (ii) because the lack of connection of the debt transaction with Spain, the Spanish elements of the debt have been artificially incorporated to the debt…

Groucho Marx: Those are my principles, and if you don’t like them… well, I have others

ng their legal defence on 2 items:

ng their legal defence on 2 items:

persistently excused itself from any wrongdoing by stating that, although they do not confirm nor deny that abundant Equity Release advertising misrepresents the truth, “…ultimately, it was the choice of the consumer to rely on the representations made, or not, having been previously warned that they should seek independent advice.”

persistently excused itself from any wrongdoing by stating that, although they do not confirm nor deny that abundant Equity Release advertising misrepresents the truth, “…ultimately, it was the choice of the consumer to rely on the representations made, or not, having been previously warned that they should seek independent advice.”