admin

This user hasn't shared any biographical information

“Do not lie down but stand up and fight them!"

A recent Supreme Court ruling (March 2015) has sent shock waves through the many insurers that are offering single premium life insurance policies. Whether named as unit-linked single-premium life assurance policy, life assurance bonds, capital assurance or any other more or less fanciful denomination, any life insurance bond that is made up solely for the purpose of investment faces one very serious prospect: being declared void by Spanish Courts.

But this ruling has not come from nowhere: for some years already the administrative section of the Spanish Supreme Court is applying a not-too-well know article of the Consolidated text of the Private Insurance Supervisory Act, which states the following:

Article 4. Forbidden transactions and sanction of nullity. It is forbidden for insurance companies, and its conclusion will determine its utter nullity and voidness, the following transactions:

a) Those that lack actuarial technical base

But what does the word “actuarial base” mean? Simply put, traditional actuarial base or science largely revolves around the analysis of mortality and the production of life tables, and the application of compound interest. Which is exactly what these “life insurance” policies, for want of a better word, actually lack.

The Spanish highest Court, in declaring the nullity of these contracts in at least 8 rulings, has argued the following:

“Judging by its features, this contract cannot be classed as an insurance policy but a capital investment”.

“In normal insurance death impacts the assurer in such way that, when a claim occurs, it is the company that suffers a loss”

“The evidence points to the existence of a financial investment accord that pursues a tax advantage”

“The blurring of the risk element is, in these contracts, complete and distorts the very nature of an insurance contract”

“If there is no transfer of risk from insured to insurer there is no insurance contract”

“It makes no palpable difference if the insured lives or dies”

“Where age or medical condition –absence of medical questionnaire being symptomatic- are not parameters of any interest, the contract is doubtfully an insurance policy”

“It is easily observable that the risk has been all but completely eliminated from these deals, in fact the health condition of the subscribed is indifferent, to the point of disregarding the medical exam.”

“The nature of financial product has been repeatedly concluded by Section 3 of the Supreme Court”

Judging by these conclusions, thousands of contracts signed by expats face a serious risk of nullity: to name a few, Lex Life/Altraplan’ life policies, Nordea’s Capital Managed Plan, Seb-Irish Life’s Spanish Porfolio Bond, Prudential’s Spanish International Prudence Bond, Old Mutual’s Executive Investment Bond, Danske Life/Danica Life…and there is no time limitation to being a claim.

SLM (Surrenda Link Mortgages) and Premier Group will attend trial at the Bilbao Courts on the 14/07/2016. Lawyers for all parties have objected to at least three trial date appointments as they had other cases to attend.

According to the claimants’ writ, SLM and the Premier Group, both lacking permission to operate in Spain, orchestrated the marketing and sale of a financial product for inheritance tax mitigation purposes.

SLM has argued that they were just the lenders, having no participation in the investment side of the product. For its part, The Premier Group argued that they had never operated in Spain and that they are not the same company as The Premier Group that operated prior to 2009, which was domiciled in the BVI.

Lawyers for claimants proved that both companies are the same, having shares offices, telephone and fax numbers and even today, email and website addresses. The document proving this has been recently admitted by the Court as evidence in support of claimats’ allegations.

A ruling by the Courts in San Roque nullifying foreclosure proceedings, issued last December, is pending ratification following the Courts’ bizarre decision -not based in law- to grant a new term for the bank to produce a correct document (subsequently appealed).

This earlier ruling demonstrates Landsbanki’s contempt for Spanish laws, whether procedural (failure to produce statutory documents) or substantive (flouting Inheritance Tax prohibitions).

Lawyers for the defendants expect a definitive ruling annulling these foreclosure proceedings to be issued in due course.

Attached Document: LandsbankiNullVoidness

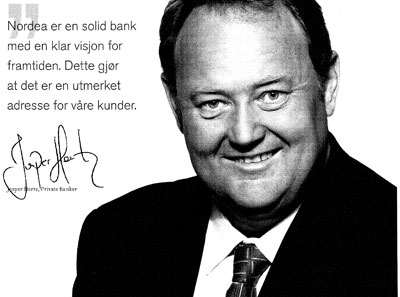

(Nordea bank giving money to charity whilst they go about their business of cheating pensioners)

Nordea Bank Luxembourg’s tricks have been exposed on the YLE TV, Finland’s national channel.

In the film it can be seen how Mr. Jesper Hertz, managing the Marbella office, declined to comment as he arduously strolled into his office.

You can watch the video here.

(Mme. Yvette Hamilius, aka Mme. Yvette Horribilius)

Court Number 1 in Marbella has ruled that a mortgage foreclosure claim brought by Landsbanki should be set side and declared null and void.

The Court was satisfied with the allegations, submitted by a Landsbanki Equity Release Victim, concerning faulty and/or insufficient notification of claim and defective filing.

Landsbanki representatives attempted to rectify their error at a later stage during the process, being rejected forthwith by the presiding Judge.

Landsbanki has the right to appeal with the Malaga Appeal Court, which they may do within the next 20 days. This option appears unlikely as there are no objective grounds to do so; there are crucial documents missing and the ruling is clear.

If Landsbanki do not appeal or they go ahead and lose the appeal, the foreclosure route will be closed for good, forcing Landsbanki to issue declaratory proceedings, slower and with ample scope for the victim to argue the fraudulent nature of the contract.

Finnish TV channel have been recently following the activities of Danske Bank International S.A and Nordea Bank S.A. (as well as the Swiss branch) in Spain and to this extent, they traveled to Marbella to film some victims of these highly dishonest individuals.

One of these cowboys is the man on the picture, Jesper Hertz, an expert in cheating customers by advising to take out loans against Spanish properties owned outright by expats so that they can avoid Spanish Inheritance Tax.

The Finnish TV wants to know how come these bank operate with such wildly diverse standards depending on where they are based i.e. Finland, where they preach the highest values of morality, integrity, honesty, compliance with the laws and, on the other hand, Luxembourg and Spain, which are truly tax evasion laboratories.

More to follow.

Surrenda Link Mortgage Funding has formally responded to a claim filed by a number of victims of the Equity Release and have, fundamentally, denied any responsibility in selling anything but an English loan guaranteed with a Spanish mortgage.

Surrenda Link argues the following:

designer of a financial product involving mortgage loans for a British investment firm.