admin

This user hasn't shared any biographical information

“Do not lie down but stand up and fight them!"

The Court of Appeal in Paris, in a ground-breaking ruling of the 24th of September, has ordered that a number of employees of the almost defunct Landsbanki face trial for fraud.

The indicted individual (cited below) will now stand formally accused of several counts of fraud, namely:

The persons accused of fraud are:

Bjorgolfur GUDMUNSSON (Icelandic), Gunnar THORODDSEN (Icelandic), Torben BJERREGAARD (Danish), and the managers Olle LINDFORS (Swedish), Morten Juul NIELSEN (Danish), Thomas NIELSEN (Danish), Vincent FAILLY (French) and the sales representatives, Robert ANTHONY (British) and Pascal MARCEROU (French).

The previous post published on ERVA explains that Michael Richardson, founder of the above 2 companies, does not hide the fact his 2007 company -The Premier Group (Isle of Man) Limited- is the successor of the BVI-based Premier Balanced Distribution Inc.

But now, the Financial Supervision Commission has confirmed that not only did one take over from the other but that they are, in essence, the same firm.

An FSC officer has confirmed, unofficially, the following:

For CAINS Advocates though they are two totally separate companies with no connection whatsoever, according to their “independent” report filed with the Bilbao Courts. CAINS says the following in its report:

Nothwithstanding that Cains acts as Isle of Man legal adviser to the The Premier Group (Isle of Man) Limited, we shall act objectively and our statements shall take into account all circumstances which may prove to be favourable as well as those that may cause harm to any of the parties of the proceedings previously stated.

CAINS is employed by the 2007 The Premier Group (Isle of Man) Limited and were also the appointed counsel for the BVI company and they therefore should and could have known that their statement is at best inaccurate and misleading and at worst, fraudulent.

This breach constitutes serious professional misconduct and failure to comply with the principles, rules and regulations of the legal profession in the Isle of Man.

The Premier Group (Isle of Man) Limited has formally responded to Court papers filed by Equity Release Victims against this company and SLMB, their lenders.

The main allegations contained in the writ reveal a great deal of anxiety and worry, consistent with a very significant claim value of circa 6 million Euros.

In their defense, The Premier Group has avoided alluding to inheritance tax, lack of regulatory authorization to operate in Spain and financial miselling. Their main argument, aided by a partisan “independent” report drafted by their Isle of Man lawyers, CAINS, is that The Premier Group (Isle of Man) Limited was incorporated in July 2007 and therefore, could have never had anything to do with the SITIRS (Spanish Inheritance Tax and Income Release Scheme) which, according to their independent lawyers, was devised and promoted by ‘another’ company called “Premier Balanced Distribution Inc”, based in British Virgin Islands, a revelation that logically exonerates them from any responsibility and thus…case closed!

Such is the confidence of The Premier Group’s Spanish counsel that they liberally dub lawyers acting for the claimants as clumsy and inept, considering the magnitude and implications of this gross oversight.

What these lawyers have not realized is that Mr. Michael Richardson (photo), the mastermind of this illicit tax-evasion mechanism, boasts the following on his website:

In 2001 founded the forerunner fund group that became Premier and has been actively engaged in the design and management of many offshore funds.

The extent of this legal bungle is corroborated by yet further admission that they are, in essence, the same company:

The Premier Group (Isle of Man) Limited (“Premier”) is the successor of a fund group established in 2001 and is responsible for designing, distributing and managing a range of investment funds to investment intermediaries and financial institutions throughout the UK and international markets.

Further evidence that supports that both companies are the same will be produced in Court and, where appropriate, divulged in this website.

As for SLMH, they have not yet filed their defense papers that we are aware of.

Court Number 1 in Denia has given lawyers acting for claimants 30 days to submit a list of questions they wish Mr. Baron David de Rothschild responds to.

The Court order implies that Mr. Baron David de Rothschild will be heard at a French Court, and not in Spain, as was initially petitioned.

Whichever way, Mr. Baron David de Rothschild will be formally indicted in a criminal case as soon as the Denia Court processes an international ‘letter rogatory’, through the Paris-based ‘liason Judge’ Javier Gómez Bermúdez (on photo) -a well-known Spanish former National Audience Court Magistrate-, in charge of providing a channel of communication to French Courts.

The State Prosecutor whose opinion was sought by the Denia Court on the matter of Mr. Baron de Rothschild Summons has confirmed, in a short writ, that the deposition of the banker may take place in France -via the designated national Court-.

If this is the case, the acting lawyers will be given a date to submit a list of deposition questions, with a translation into French.

It is also possible for lawyers acting for claimants to attend the interrogation.

A Marbella Court has ordered a stay of foreclosure proceedings following a ‘null and void’ petition submitted by lawyers acting for the defendant.

The application to the Court is based on fundamental breaches of civil procedure laws, namely failure to identify the correct sum that Landsbanki is demanding from the borrower.

Landsbanki has so far only foreclosed on company-owned property, that we are aware of.

Should the Court set aside the foreclosure procedure, Landsbanki would have to pursue the debt via a laborious ordinary case where parties get equal opportunities, as opposed to foreclosure proceedings.

Landsbanki has 5 days to challenge this decision.

LETTER TO LANDSBANKI CUSTOMERS ARE SENT BY FIRM LAWBIRD LEGAL SERVICES

Dear Sir/Madam,

We are due to soon file proceedings against Landsbanki Luxembourg S.A., Lex Life Luxembourg S.A. (and/or its successor) and Offshore Money Managers.

The main reason for the delay in filing has been due to our firm considering, in the light of the content of writs submitted by Landsbanki Luxembourg, that a claim for misleading advertising should include also excerpts of the cases where Landsbanki lawyers admit –in at least there occasions- that the main reason why this product was offered to the public was as means to -legally- reduce or mitigate Spanish Inheritance Tax.

These crucial undertakings by Landsbanki lawyers indicate that the bank willfully engaged in marketing and selling a bogus tax planning scheme, as confirmed by the Spanish Tax Office in 2013. More so, Landsbanki lawyers confirmed that a brochure explaining the inheritance tax planning was give out to all clients and that this was therefore one of the main reasons, if the principal, for property owners to acquire an Equity Release.

The case is therefore aimed at establishing whether the advertising was truthful or not and where not, from the point of view of an average reader, if the content would have been explicit enough to persuade readers to acquire the Equity Release Scheme. This signals a departure from classic the case argument aimed at establishing misselling of financial investments took place and rather concentrates on the tax mitigation perpective.

It is only through this strategy that we will be able to request that art. 1,306 of the Civil Code is applied to these cases, the only real option to avoid having to repay the draw down if there is a successful outcome.

Article 1,306. If the deed which constitutes the unlawful cause should not constitute a crime or misdemeanour, the following rules shall be observed:

Along with Landsbanki and the successor of Lex Life, we have decided to issue proceedings against OMM (Offshore Money Managers), a pseudo-IFA who was nonetheless prolific in their advertising efforts to bring customers and banks together.

Finally, the firm Cuatrecasas –no longer acting for Landsbanki or Lex Life- has confirmed in writing that they never contributed or cooperated in providing any tax planning advice, contrary to what Lex-Life advertising stated; this statement automatically renders the advertising untruthful.

With respect to potential foreclosure action by Landsbanki, we will request that the bank is served with an injunction preventing them from enforcing the mortgage loan rights they hold.

Best regards

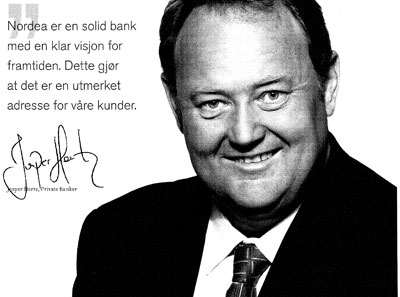

The Malaga Mercantile Court yesterday held a hearing on ocassion of a misleading advertising case against Nordea Bank Luxembourg S.A. and its Swiss branch.

An overweight Jesper Hertz, for the defendants, lied to the Court shamelessly. He confirmed that the bank had never offered any tax or fiscal advertising, information or otherwise to clients and that all they did was offer investment advice. Jesper’s dishonest intervention depicted a scenario of deceipt and will be remembered as the worst example of the hypocrisy and underhandedness of today’s bankers.

Nordea’s legal advisor questioned the quality of “advertising” of the promotional literature, stating that it made it clear that such information was not advice, but a mere guidance.

They also referred to the date on the main booklet (2008), arguing that it would have been impossible for claimants to have relied on it.

Finally, they dismissed the information provided to customers as mere investment guidance, arguing that it was the loss of such investments that had prompted the Nordea’s clients to sue the bank, and nothing else.

Claimants were able to prove that Nordea extensive tax advertising was misleading, confusing and inaccurate with the aid of 2 Tax Office binding rulings, the expert witness opinion brought in by the claimants (Carlos Jimenez Dengra) and an abscence of any proof to the contrary by Nordea, save for half-hearted attempts to discredit the evidence brought in by the victim’s legal team.

With respect to the booklet date, it was held in Court that previous brochures (2005 and 2006) had inspired the 2008 booklet for identical paragraphs appear on both sets of promotional advertising. It was also held that no where in the advertising did Nordea Bank discuss the product as being an investment proposition but rather, a tax planning tool for the inheritors.

The case is ready for sentencing.