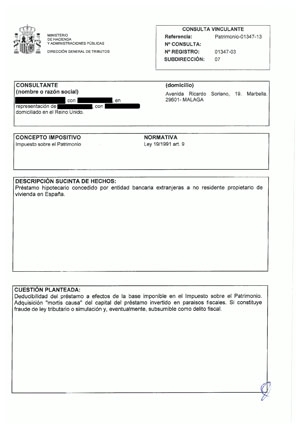

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

What are the implications of this conclusion for the banks?

In principle, the consequences can vary enormously depending on whether banks misrepresented their clients by making them believe that they could mitigate taxes legally, when this is untrue, and this can be proven in a court of law. Where proven, the contracts can be declared void and the bank forced to lift the mortgage on the property, and by application of article 1.306 of the Civil Code, be prevented from claiming the draw downs.

Banks that have assisted inheritors in collecting life assurance/insurance payments on death of the policy holder, without demanding that taxes were paid, can become “substitute taxpayers” and end up footing the bill. Where the owed tax exceeds €120,000, this could constitute a crime under the Spanish Penal Code, punishable with prison terms.

And for property owners?

Taxpayers may have effectively mitigated taxes by declaring the charge to represent a “true” debt, in the belief that they were doing the right thing. The right of the Tax Office to demand unpaid taxes are not compromised by virtue of agreements between the cheating banks and their victims and so, they can pursue taxpayers.

One thing is now clearer: property owners are now in a far better position to pursue the declaration of voidness/nullity of the equity release agreement, as a single juridical contract, given the gross misrepresentations by banks, and their agents, when selling this fraudulent product.

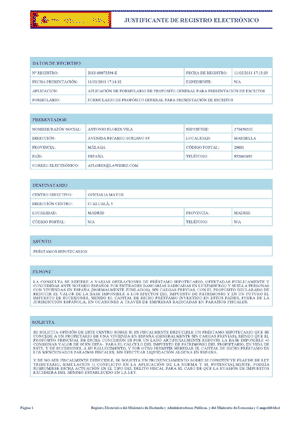

Documents