This conversation was taped by the son of a Danske Bank International S.A. victim, and Soren Glente, at the time one of the bosses in charge of selling the Capital Assurance. The conversation had already been postedin this site but now, we have the most relevant parts in writing.

In the recording Mr. Glente, a classic Luxembourg-based Danish banker, has a rare fit of honesty and sings like a canary:

Minute 15:00 onwards

S.B.: How would you describe the risks of this product?

Soren Glente: Well ehhh depending on how aggressive the client would like to be then, I mean if you did it only for the purpose of optimize your tax situation. Then the risk is quite small, it will cost you something each year, I mean the difference between what you paid and the interests of the loan and what you could achieve on interests of the and if these were place cautionally the income from the assets would be less than what you paid on the loan, and that would be the price of …

S.B.: and was that made clear to the client?

Soren Glente: oh yes sure, for the

S.B.: so the income from the loans, sorry the income from the assets and investment would never cover the loan? Ehh?

Soren Glente: no , if you wanted to have a very cautious investment profile, then you couldn’t you couldn’t have , the income couldn’t achieve the cost of the loan, no. if you wanted to to achieve that on the loan , then you had to be take some kind of risk, like buying more risky assets

S.B.: so it was really ehh

Soren Glente: and so on and so on

S.B.: so in order to be low risk it was loss making

Soren Glente: yes, that’s for sure

S.B.: and loss it was going to accumulate every year

Soren Glente: yes, not by much, but yes, it would, it would accumulate each year because you would be ehh, you would be able to get an income from, let’s say your deposit or your short term bonds which would be ehh, the income would be less than what you paying interests on the loan, so therefore it would accumulate each year, yes it would

S.B.: do you think my clients understood that?

Soren Glente: yes they did, because I explained that to them, when I had meetings with them, I explained them , because I was, when I spoke with clients ehh or with your parents ehh, they were, in the beginning the investments was very conservative placed by me in an agreement with them, and then each year they could see that the capital actually degrees value, that the assets couldn’t provide income which would pay the interests of the loan, so therefore they came to me actually and ask whether I, we should consider changing the assets to more risky assets, in order to achieve a higher income, so I had a long dialog with your clients, ohh with your parents about that, because I had to tell them that if they wanted that, the risk would increase and as far as I remember we agreed to take a small portions of your parents’ assets and place them in a slightly risky assets, in order to at least break even, that is as far as I remember, but you could see, but you should be able to see that on the notes or… so that’s what happened. So I remember I had a dialog with your clients, with your parents in the bank sometime

S.B.: mmm mmm

Soren Glente: but we are going many years back now

S.B.: right, well I think that they did not understand it, I don’t think that they understood that from the beginning when they signed up to this contract, that this was going to run it to loss, if it was going to be lowerer QQ

Soren Glente: no, you might be right. That they didn’t because, you might be right that they didn’t understand that

S.B.: mmm there were…

Soren Glente: many many clients on the costa del sol didn’t understand that you can’t just, you can’t you can’t just automatically make money out of the negative equity, which it actually was, without taking risks and that has been the case for many many unfortunate clients down there that they are they have placed assets on too risky assets too risky assets like equities and things that were having a loan on both the house and the assets

S.B.: did you know the others, do you know, how many other clients did you have like my parents?

Soren Glente: several

Up to minute 20:00

Minute 32:50 onwards

S.B.: and do you still sell this Company insurance scheme product?

Soren Glente: yes, by all means if people they are wanting to tax optimize their situation then that is one of the best schemes you can sell in.it really is

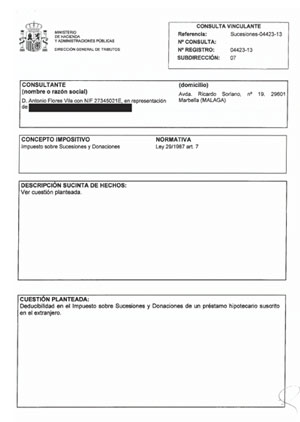

S.B.: but there is dispute about whether it does actually protect against Spanish inheritance tax, not everyone says, not everyone says it protects

Soren Glente: yes, but I have got a legal opinion saying differently

S.B.: from who, may I ask who from?

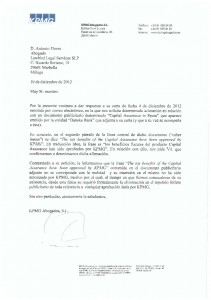

Soren Glente: it was from several other companies Price Waterhouse Coopers in Spain in Madrid, we have a legal opinion from these guys

Minute 34:03

Soren Glente: Yo have to do it right to have it to work, but it does work, you just have to know that the reason for doing this is not to release your equity from the property to in order to buy a new car or whatever you want to, the reason for doing this is to optimize your situation for wealth tax and yeah mainly inheritance tax, wealth tax was also an issue, but it is a lesser issue today