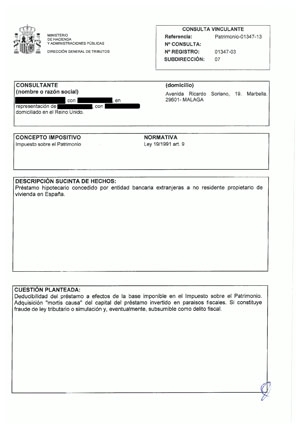

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

What are the implications of this conclusion for the banks?

In principle, the consequences can vary enormously depending on whether banks misrepresented their clients by making them believe that they could mitigate taxes legally, when this is untrue, and this can be proven in a court of law. Where proven, the contracts can be declared void and the bank forced to lift the mortgage on the property, and by application of article 1.306 of the Civil Code, be prevented from claiming the draw downs.

Banks that have assisted inheritors in collecting life assurance/insurance payments on death of the policy holder, without demanding that taxes were paid, can become “substitute taxpayers” and end up footing the bill. Where the owed tax exceeds €120,000, this could constitute a crime under the Spanish Penal Code, punishable with prison terms.

And for property owners?

Taxpayers may have effectively mitigated taxes by declaring the charge to represent a “true” debt, in the belief that they were doing the right thing. The right of the Tax Office to demand unpaid taxes are not compromised by virtue of agreements between the cheating banks and their victims and so, they can pursue taxpayers.

One thing is now clearer: property owners are now in a far better position to pursue the declaration of voidness/nullity of the equity release agreement, as a single juridical contract, given the gross misrepresentations by banks, and their agents, when selling this fraudulent product.

Documents

As always erva are good to their word. From what I can see it does not get any more official than this document from the Hacienda. I will down load this and have it framed in a nice picture frame and hang it in a very prominent postition in my home. No doubt the banks will do the same and hang it in their toilets. There is nothing more to be said as the thoughts of the banks victims have already been expressed in the previous post.

From your erva team.

This is a very important ruling for all equity release victims and of course affects many who are currently paying wealth tax at a reduced rate. Pleae bear in mind that for the year 2011 – 2012 it will not now be possible to reduce your wealth by the amount of the so called mortgage loan. We need to get this message out to the general public and have therefor decided to issue a press release in the English newspapers.

Perhaps our members are feeling a little vulnerable after this ruling,however don’t panic. Although these schemes are not legal to avoid taxes, the owners of the properties would pay tax on the full value of the property, as if they did not have a mortgage on them. This would apply to all types of taxes. Currently wealth tax is paid on assets worth 700,000 Euro and above and for residents, there is an additional allowance of 300,000 Euro on the habitual residency. This means that currently few expats will be subject to this tax. For example, a non resident with a propery of 1 million Euro will pay only on 300,000 Euro, which works out around 800 Euro. There is a sliding scale which increases the percentage as the value of the property/wealth increases. So speak with your tax adviser.