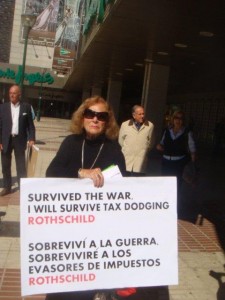

ERVA seems to have a fixation with Rothschilds when it comes to exposing the cheek and skullduggery of bankers, but this is not the case; it is rather that this sadistic and innately sinister corporation, intent on perpetuating stress-related ailments on people who were otherwise perfectly healthy -financially too- can hardly raise any sympathies.

Victims of this company’s plan to deceive expats generally express a familiar emotional pattern, when talking about this scheme: their worries quickly dissipate and give way to anger and fury, more so when they find out, to their horror, the pack of lies they were subjected to.

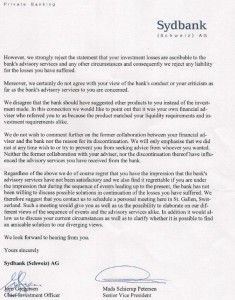

In 2012, Rothschild is saying this:

Hamiltons were your financial adviser and acted as your agent in relation to your application for a CreditSelect loan facility, we are not able to accept responsibility for any advice that may have been given to you by Hamiltons.

But in 2006, Rothschild was saying this:

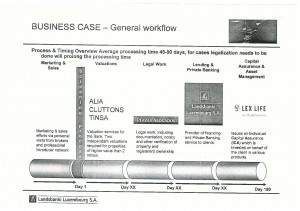

Our innovative product CreditSelect is available throughout a network of financial advisers around the world, thus giving clients straightforward access to credit for a while range of purposes…”

To Help Support those professional financial advisory firms with whom we have agreed terms of business for the availability of CreditSelect, we have a website dedicated to assisting the promotion and delivery of the service…”

This website is regularly updated to ensure that our introducers have round the clock access to all facility documents for downloading and printing…clients brochures, the latest Funds List…”

Our product CreditSelect has been so successful that we have restricted its availability to a handful of quality introducing intermediaries”

Mr. Mark Countanche and Mr. Peter Rose, a piece of advice: your compulsive lying is going to take you nowhere, given the crystal-clear evidence of paper trail you have left behind, not to mention that you actually taught, trained, coached and instructed Hamiltons Financial Services, Henry Woods Investment Managements and others, accordingly.

Change your strategy, change your lawyers and do it fast. Oh, and avoid “unworthy of trust” firms that are just clocking up hours regardless of the quality of the advice they are giving, being with the “largest firm” will just not help you.

allegations we make so, if there is proof that the attached is a fabrication by all means, we will have it removed.

allegations we make so, if there is proof that the attached is a fabrication by all means, we will have it removed.

ng their legal defence on 2 items:

ng their legal defence on 2 items: