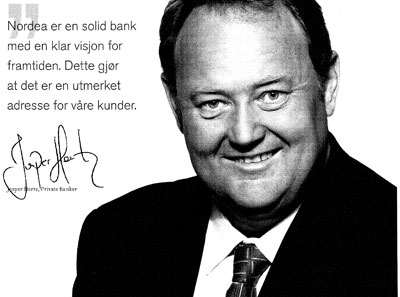

Can you trust this man? Definitely not, if he is trying to sell you a mortgage + life insurance/capital assurance product.

Can you trust this man? Definitely not, if he is trying to sell you a mortgage + life insurance/capital assurance product.

Can you trust his company? As above.

Why? Because he will be lying through his teeth, as he has done in countless occasions in the past, and will tell you that this product is a fantastic opportunity for expats that have no mortgage on their properties as it will give them access to cash and also, eliminate taxes, none of which is true. Additionally, he will tell you that your property will never be at risk and that you should trust them because of their Nordic values, which he claims other bankers don’t enjoy. So far a few people have had their homes repossessed.

What do you mean by Nordic values? Nordea says that their company and staff are imbued of certain principles (integrity, impartiality, honesty, directness, flexibility and the ability to understand and treat clients like human beings), and that this differentiates them their competitors. If we interpret this literally, it would mean that bankers from say Afghanistan, Chile, Somalia or Spain lack integrity, are dishonest, biased and treat clients like animals…

What was this man’s role in the selling of Equity Release? Jesper Hertz was in charge of selling and signing off Equity Release products for Nordea Luxembourg in Spain. Wherever his company was not present, like in the Alicante/Murcia areas, he would reach out to potential customers through an agency network of rogue financial advisers, imposters who had easy access to the British expat community through years of presence on the Spanish Costas.

Did Jesper Hertz tell his customers that they would never lose their homes? Absolutely. Had he been transparent and honest, not one of his customers’ homes would have been at risk because not one would have signed the product, as simple as this. It was the obligation of Nordea, and Hertz, to specifically indicate their customers that this was a fraudulent product. On the contrary, Nordea’s mission was to come across as an elegant, sophisticated and trusted bank that would look after you to and, as they repeatedly insisted, preserve your wealth and look after your loved ones.

Their literature makes ludicrous and false statements such as : home sweet home…your most precious asset…keeping it in the family…our in-house specialists possess a deep and extensive knowledge of these virtues…we ensure that our advice is always open-minded, direct and honest so that we never promise you any more or any less that what is realistic…trust us…let us be your confidant.

You are talking about fraud, now that is a serious allegation! Jesper Hertz, from his office in Marbella, marketed, promoted and sold the virtues of a tax evasion cross-border service, similar in concept to the one UBS set in the US that cost them a criminal indictment (PDF). Although far modestly in means and resources compared to the Swiss bank, Nordea has still managed to create a refined set of promotional brochures that minutely explains how legal it is to register an artificial mortgage on your home, take the proceeds to a tax haven and have your inheritors receive the money abroad, without paying taxes, whenever you pop your clogs.

Why is it all wrong then? The problem is that you cannot register an artificial mortgage to make the tax authorities think that you have a real one, it is just illegal. And yet, Nordea Luxembourg organized a marketing campaign based on this premise. Secondly, it is wrong to tell your customers that you can inherit the proceeds of a life insurance/assurance product without paying taxes, quite simply because the law says that you pay IHT in Spain, whether you are a resident or a non-resident (and irrespective of the policy-holder being a resident or not).

How would you summarize Nordea Luxembourg Equity Release product? Tax cheating, customer deception and lack of values, all in one.

Victims of the Landsbanki Equity Release scam have filed a complaint against the bank Landsbanki for criminal swindle.

Victims of the Landsbanki Equity Release scam have filed a complaint against the bank Landsbanki for criminal swindle.