The farcical testimonials are testament to the immense deceit rained on unsuspecting punters. We just wonder what happened to them…

Archives for March, 2013

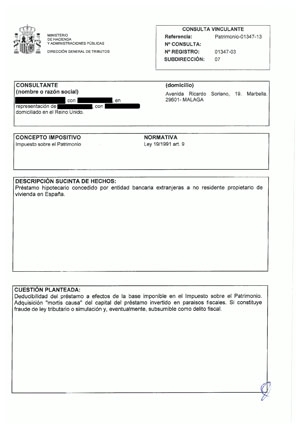

Equity Release for Fiscal Planning is Tax Fraud, Confirmation in Writing Received

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

As explained on a previous post, the “Hacienda” has now confirmed what many believed: that attempting to mitigate inheritance and wealth taxes by taking out a mortgage loan on a property that was otherwise unencumbered is tax fraud.

What are the implications of this conclusion for the banks?

In principle, the consequences can vary enormously depending on whether banks misrepresented their clients by making them believe that they could mitigate taxes legally, when this is untrue, and this can be proven in a court of law. Where proven, the contracts can be declared void and the bank forced to lift the mortgage on the property, and by application of article 1.306 of the Civil Code, be prevented from claiming the draw downs.

Banks that have assisted inheritors in collecting life assurance/insurance payments on death of the policy holder, without demanding that taxes were paid, can become “substitute taxpayers” and end up footing the bill. Where the owed tax exceeds €120,000, this could constitute a crime under the Spanish Penal Code, punishable with prison terms.

And for property owners?

Taxpayers may have effectively mitigated taxes by declaring the charge to represent a “true” debt, in the belief that they were doing the right thing. The right of the Tax Office to demand unpaid taxes are not compromised by virtue of agreements between the cheating banks and their victims and so, they can pursue taxpayers.

One thing is now clearer: property owners are now in a far better position to pursue the declaration of voidness/nullity of the equity release agreement, as a single juridical contract, given the gross misrepresentations by banks, and their agents, when selling this fraudulent product.

Documents

Equity Release for Fiscal Planning is Tax Fraud, says Spanish “Hacienda”

The Spanish Tax Office has finally ruled on the validity of using mortgage loans to avoid wealth and inheritance taxes.

ERVA will post the original binding consultation letter, named as CONSULTA VINCULANTE Patrimonio -01347-13, in the next couple of days.

Meanwhile, this is what they had to say about this dodgy set up:

- That a calculation for wealth tax cannot take into account, and be reduced by, the value of the mortgage loan, unless the loan is used for the purpose of financing the acquisition of the property, as it is not otherwise considered to be charge on the property, but a personal debt.

- That according to article 7 of the Inheritance and Gift Tax Act, non-residents for tax purposes will have to pay taxes on any sums received from life insurance policies signed by Spanish companies or foreign companies operating in Spain.

- That the capital of a mortgage loan granted to a non-resident by a foreign bank is not subject to IHT.

- That attempting to offset a mortgage as described above would constitute tax fraud, pursuant to the General Tax Act 58/2003

Further to the above, we received a clarification email stating the following:

- That a calculation for IHT cannot take into account, and be reduced by, the value of the mortgage loan as logically, the mortgage loan is not considered to be a charge on the property but a personal loan.

Email sent to ERVA:

From: S.G. de Impuestos Patrimoniales, Tasas y Precios Públicos

Sent: miércoles, 06 de marzo de 2013 12:26

To: Fatima Izquierdo

Subject: RV: A/A D. José Javier Pérez-Fadón Martínez_Consulta vinculante_Patrimonio 01347-13

Estimada Sra. Izquierdo: La contestación V0590-13, fechada el 25 de febrero pasado, establece la no deducibilidad en la base imponible del Impuesto sobre el Patrimonio, para supuestos de obligación real de contribuir, del préstamo hipotecario extranjero en cuanto no es carga o gravamen de la vivienda, sino deuda. En el ámbito del Impuesto sobre Sucesiones y Donaciones y para la misma hipótesis de obligación real de contribuir, como decíamos en la mencionada contestación, el causahabiente no tributará por el capital del préstamo y, como es lógico y resulta de no tratarse de carga o gravamen sobre la misma, tampoco podrá minorar el valor de la adquisición de dicha vivienda en el importe del préstamo.

Confío en que quede así aclarada la cuestión planteada.

Saludos.

Javier Pérez-Fadón Martínez.

Subdirector General de Impuestos Patrimoniales, Tasas y Precios Públicos.

Finally, we have requested from the Tax Office that the email below is incorporated to a binding letter.

Bank Demands Proof Of Payment of Death Duties on Life Insurance

Unlike Nordea Bank Luxembourg, Unicaja is sending letters out to the beneficiary of a life insurance policy requesting proof that an IHT form was returned to the Spanish Tax Office, prior to releasing the funds. The bank even specifies the sum of money that needs to be declared and the appropriate box in the form, and they will not release any payments under life insurance policies until this is verified.

Unlike Nordea Bank Luxembourg, Unicaja is sending letters out to the beneficiary of a life insurance policy requesting proof that an IHT form was returned to the Spanish Tax Office, prior to releasing the funds. The bank even specifies the sum of money that needs to be declared and the appropriate box in the form, and they will not release any payments under life insurance policies until this is verified.

- Why would Nordea Bank Luxembourg not do this? Very simple, they sold the Unit-Linked policy to precisely avoid the taxes which payment they are legally bound to supervise: the fox looking after the hen house.

- What does this entail for Nordea Bank? Automatically, they become liable for not only scheming to defraud the Tax Office, an offence that

could see them be prosecuted criminally but by virtue of article 8.b of the IHT Act 1987, they become “substitute taxpayers” if they pay out on life insurance policies without ensuring that the correct tax has been paid, save for the exceptional payment to the Spanish Tax Office, provided that a check is given to the beneficiaries under the policy and such check is written out to the appropriate Spanish tax department. - Could lawyers also be taken to task for aiding tax evasion? They could and they would, particularly where their professional and technical skills are used to assist in the commission of fraud.

- What is the most serious consequence if the client, and his bank, get caught out? Currently, where the unpaid tax exceeds €120,000 per tax year, the taxpayer and his accomplices could face imprisonment (up to 5 years) and more severe consequences if, for example, complex fiscal engineering or tax havens are employed to further the crime. A prison term is just unavoidable unless the taxpayer repents and decides to make a full disclosure, or Statute of Limitations kicks in.