It has been discovered, with some distress we may add, that the much flaunted Court victory of a Landsbanki victim in 2011 had more to it than met the eye for, whilst the victim won a ruling in the First Instance declaring the mortgage loan and the investment contract void, the ruling was subsequently revoked entirely, on appeal, by the Málaga Appeal Court (ruling dated 18th February 2013).

In principle, not good news for pessimists but being practical, one can extract in interesting conclusions on how should a new claim be filed, what laws be invoked, the extreme importance of supporting evidence or even, the situation with Landsbanki’s bankruptcy. Below is a very sketchy summary of the case (a more comprehensive resume will follow):

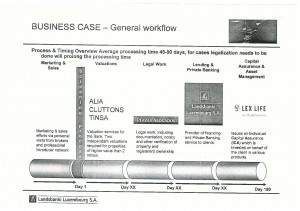

– OMM was sued together with Landsbanki, but Lef Life was left out (even if their contract was attacked by the claimant’s legal representation).

– The claim was based heavily on mis-selling within a financial investment contract, as opposed to an Equity Release contract or even a mortgage loan but then, the party to the financial product -a Unit Linked Life Insurance Policy- was not sued jointly.

– Mentions were made to IHT benefits but apparently so, no evidence that this constituted fraud or, at the very least, not proven. The Court of Appeal in fact admits that the substance or essence of the contract is actually Tax Mitigation, and that there is no error there (!!!). More so, the Appeal Court does even go to name product, Spanish Inheritance Tax Reduction Arrangement (SITRA).

– The claim confused the mortgage loan contract with the investment portfolio contract, and it was not proven they were one single overall agreement with several contracts in it: the Malaga Appeal Court outlined this.

– The claim invoked the 47/2007 Securities Markets Act when it was not applicable at the time of the claimants signing their ER contract.

– The Appeal Court noted that there was a general lack of evidence in support of the claim, in particular to do with failing to prove that either defendant guaranteed the improbable fact that the investment yield would suffice to cover the mortgage repayments as well as,

On a side note, we must add that OMM came out victorious for 2 reasons: a) they were deemed as business introducers, nothing more and b) even if they were selling financial products, the Court found that life insurance unit-linked contracts were within their remit, considering they did have an insurance brokerage license.

The upside is that the Court of First Instance did find both defendants guilty of mis-selling which should make Landsbanki wonder what would happen if, for instance, a new claim was filed against them addressing all the above shortcomings/incorrections, as they were highlighted by the Appeal Court, in particular the position of the Spanish Tax Office.

In our opinion, the case should be revisited and the Court of Appeal shown that they have just endorsed, unknowingly, a tax evasion product…