And so it was, that, in relation to an Equity Release fraud case in Spain against Danske Bank Luxembourg, the defendant held the following:

We conducted our due diligence according to the internal rules and procedures Danske Bank Luxembourg has in place. As part of this process, the Capital Assurance product, sold on the basis of a tax-planning proposition, was fully cleared by KPMG. We therefore reject the claimant’s action for it is groundless, without merit, and we will defend ourselves vigorously.

Fully cleared by KPMG? What does that really mean in Danske Bank Luxembourg banking jargon?

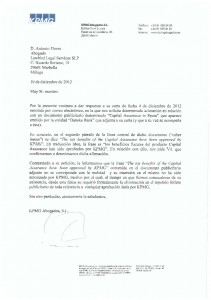

Mr. Klaus Mønsted Pedersen: have you read the attached document by KPMG Madrid, denying that they ever gave the blessing to the cash-predatory tax-evading Capital Assurance Product, ever authorized your company to use their name and in fact, formally requested you to eliminate from the brochure any reference to the product being approved by KPMG?

Well, are we now, perhaps getting to the truth. Do Danske Bank, of course they do, know that by quoting such a well know and respected firm of tax accountants as KPMG, they are libelling the good name of KPMG. Not only that, but as a result of this, they are convincing unsuspecting clients to sign up to a fraudulent and criminal product. I don’t know what the law is in Spain. In England this would be criminal deceipt. KPMG should bring this bank to task and get them to apologize for using their name in vain. I apologize to KPMG for doubting their professionalism. Danske Bank you are nothing but, criminal, fraudulent and deceiptful cheats and deserve all that is coming to you.

Of course they have read it, it probably p…..d them off, now all of a sudden they had a problem. What shall we do. Pedersen replied, lets just ignore it, they will probably never find out what we have been up to, especially if we keep their name on the document. We can still launch this products and screw them into the ground, KPMG name is crucial to our scam. Well, well, you did not count on Hercules Poirot (alias Anthonio Flores) that famous detective and discoverer of rogues. They should have known better. Now I am not sure of what they call this scam in Spain in the UK “it is obtaining money by false pretences” the local fuzz (slang for police) would be round, you’d be nicked and taken off to some wonderful comfortable jail for a couple of years. Back in the 1700’s it would have been that well know penal colony Australia. No offence to the Australians they are a wonderful people and great country. In fact the Aussie’s would propably like to reverse this and send them back to the UK.

I know it says Capital Plan and relates to Danske Bank. Is his similar to the Unit linked life insurance policy where Nordea Bank placed the funds, if so are they not also as guilty of committing the same type of fraud. If there are any Nordea victims out there perhaps they would reply.

How can it possibly be that Danske Bank can lie to the courts. They knew or should have known at the time that KPMG had not endorsed the scheme, as they knew it was illegal, so how can they say it was “fully cleared with KPMG ” Surely if the courts were aware of this they would summon everyone to the courts immediately to explain their actions and then indict Pedersen on criminal charges. Lock him up and throw the key away.

How about denial by Danske Bank that they did not use the services of the KPMG??!!. KPMG has stated that their name was wrongly added to Danske Bank´’s advertising literatura by the Bank without their consent or permission and this Notarised statement has been served on the Court to add to the evidence has that has already been passed to the judge to add to the rest of the damning information against Danske Bank and its employees. This should be the last piece of evidence enough to convince the Judge that the actions of Danske Bank and its employees were criminal.

It is time for these Danske Bank persons to come to Court in Spain and explain how they managed to lose all the old age pensioners money.

When any conditions of any contract are not correct then that contract is considered null and void. If the contract refers to the assigning of one´s property to a bank like Danske Bank who offered to reduce Inheritance Tax Liability (IHT) , invest that mortgage and make profit and give some cash (Equity Release) at that time…..then that mortgage is ilegal and cannot be allowed to continue. If that bank (Danske Bank) then loses 80% of the investment over seven years through mismanagement and huge annual management charges then criminality must be considered.

To cap it all Danske Bank added KPMG (a very highly respected financial company ) without permission to their advertising propaganda!! Sincé this new evidence has come to light then it is time for Danske Bank to answer for its total incompetence and cheating the old people who had no mortgage.

Come on Danske Bank and all the other Banks that have robbed the victims by use of their glorious cheating schemes. Rothchilds, Nordea and all the other financial authorites who misled and cheated the old ones on the Costa del Sol. Come to Spanish Courts and face the music and our lawyers (Lawbird of Marbella) and Antonio Flores, the lawyer who has helped us all.

Also come and face the members of the Equity Release Victims Association (www.erva.es) and we will present you with all the evidence.

Today it has been announced that all the vicims of Bankia who lost their money will be paid back in full because of the misdemenours of that bank. This must bode well for the Equity Release Victims Association (www.erva.es) who have also lost their money by the misappropriation and bad investment of their clients money by Danske Bank, Nordea Bank, Rothschilds Bank and all the other Nordic Banks who traded and lost the “invested funds” of the misled old persons who did not understand what they were doing. You can follow this in the Spanish Press of today. The CNMV which governs banking in Spain intervened and advised the government of Spain to repay these victims in full. (See EFE…Spanish press reléase of 18th December 2012).

Surely the next step for the victims of the Danske, Nordea and Rothchilds would be to inform the CNMV of the situation and pass the evidence of the scamming of the innocent pensioners for their judgement and to the Ombudsmen…..

It must be only a matter of a very short time before the summonses are issued against all these banks

Since when has Luxembourg ever cared about what is legal elsewhere?

Doesn’t Luxembourg make its own recepies of European Law, removing some ingredients and adding others to suit the Banksters?

Is there such thing as consumer protection in Bankster Luxembourg?

Look at what the Landsbanki Luxembourg administrator Mme Hamilius turns a blind eye to and ask yourself if Luxembourg simply does not want to see what does not suit them and their Banksters?