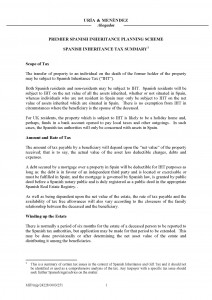

A while ago we wrote about an opinion by top firm Uría & Menéndez, who had regarded that the Equity Release scheme could be a “sham” in the eyes of the Tax Office.

Surprisingly, that same firm must have received a phone call from one of the banks -we believe it to be Rothschild- demanding that the paragraph that insinuated that the scheme could be deemed a fraud was taken out.

Et voilá, no sooner had it been requested by the keen bank than it was removed by the firm, who then issued a new report, the one we see attached.

Too see the changes, compare it to the unmanipulated report (paragraph 6).

ERVA will formally write to Uría & Menendez in the new year to confirm ths very worrying information.

In days gone by one always placed their trust in banks. I remember in the past when I needed help, I would pick up the phone, call my bank manager and pop down to the pub for a pint and a chat. They called it communication, nowadays you cannot even phone your branch in the UK. Pick up the phone and you get Mumbai and the accent to go with it. When in trouble speak to your trusted lawyers for a sensible answer that always conformed to the law of ethics. Having just read this post I am in deep despair. Does it mean that lawyers in Spain have caught the same disease as the corrupt banks. Surely there must be something other than money in life. The Spanish I have come to love as honest, hard working, god fearing family institutions, a place that the rest of the world should copy. Uria & Menendez, Abogados you have just shattered my dream. How on earth can you give up all your priciples for money, the banks have earned their lousy reputation. Please don’t follow for the sake of their account, stick to your principles and serve your clients in an honest and honourable way. You may not be aware but by your acctions you may have ruined the lives of countless pensioners.

This is indeed a disturbing post. The story gets more corrupt and sordid by the day!!

I hope Antonio and his team can get this some national coverage and show this corrupt firm up for what is it – an obedient pet of the banks!

I find it utterly despicable and corrupt that a Spanish law firm could bow to such pressure from the banks. It just shows how these banks were out to target unsuspecting victims and criminally take their lives away. It reeks of out and out fraud, in any other country in Europe the perpetrators would be jailed and the keys thrown away. I really hope that erva will do as they say and not only write to the Uria & Menendez Abogados and ask for an explanation. In fact I would go further and write to the Spanish Law Society (if there is such a thing) and report them to their own regulatory body.

Urea and Menendez should be reported to the European Justice system. Forget about Spain. They won’t do anything and this should be spread on the European press so that they are named and shamed.

Spain should hang its head in shame at such lawyers being able to have their backs tickled by corrupted Banksters?

Truly disgusting?

Everyone must react and protest very loudly about this corruption, IMOP.

This is corruption and deceit at its highest level. An amended document by a well known firm of lawyers in Madrid at the request of the bank in order to con customers of the banks to sign up for what is now know to be a fraudulent scheme. Without exception every victim of equity release only contracted because of the promises that their children would be able to mitigate IHT. Had they known the true IHT rules, there would be no victims at all. Collusion in its worse form I call it. On reading this document is there any doubt that this document was produced by Uria & Menendez for Rothschild Bank and their partners in crime and was it requested by Philip Dewsnip (then Director of Rothschild ) Dean Murphy (Hamiltons) & Charles Walton (Premier Fund Manager) . More than likely, at least as this document is headed “PREMIER” SPANISH INHERITANCE TAX PLANNING SCHEME” Evidently they instructed Uria Menendez to state the IHT Tax Laws then in place. As a result was this opinion used by other banks as their base line for their own Equity Release scheme. NORDEA BANK deliberately omitted key paragraphs from their sales & promotion brochures. In this latter case we have heard that the Mercantile Court in Malaga have admitted into court an action by 6 Nordea victims for mis-leading/fraudulent advertising and unfair competition. The worrying thing here is why did Uria Menendez omit the crucial paragraph, were they of the opinion in their first document that such a scheme would be deemed to be a “SIMULATION” debt. And therefor would not qualify for any IHT benefits for the policy holders beneficiaries. Is it within the realms of possibility that they were instructed to do so by the Rothschild crowd. This certainly needs an answer from Uria Menendez,. If not they should be reported to their own Spanish Regulatory body and possibly as George mentioned to the European Judiciary. I am sure that ERVA through their lawyers will be writing accordingly.

Utterly discgraceful behaviour. I am in agreement with all these comments, Uria Menendez should be asked for an explanation as to why there are two conflicting reports. As stated, if the first report circulated had been used by the banks, I doubt that not one person would have signed up to these schemes. This is manipulation of peoples lives to the highest order. Should a satisfatory answer not be forthcoming from Uria Menedez, they should be reported to the authorities.

A MESSAGE FROM YOUR ERVA TEAM. TO ALL VICTIMS OF EQUITY RELEASE SCHEMES.

We understand your frustration and anger at seeing such discoveries, it would appear to be damming evidence of collusion between the law firm Uria Menendez and Rothschild group. However we must give them a chance to put their case forward. We have asked our lawyer Antonio Flores, of Lawbird, Marbella to write to Uria Menendez on behalf of the Equity Release Victims Association, asking for an explanation. We hope they will have the curtesy to respond in full.

Uria & Menendez are one of the largest and most rerspected lawfims in Spain and very active on the international scene. I cannot believe they would be responsible for such behaviour. Perhaps this is not what it seems and I agree with the ERVA team that we should at least give this law firm an oportunity to respond before everyone goes off half cocked. There seems to be some skulduggery going on around these parts. In any event congratulations to ERVA and their lawyers for digging up this information, they certainly seem to have a knack of getting to the truth.

TO ALL VICTIMS COERCED INTOTAX FRAUD BY THE EQUITY RELEASE BANKS

http://www.telegraph.co.uk/finance/financial-crime/9779250/Switzerlands-oldest-bank-Wegelin-pleads-guilty-to-helping-US-citizens-evade-tax.html

By reading the above link you will of course see striking similarities into this case between a Private Bank in Switzerland and the US Authotities. This is precisely what erva have been alluring to for many months. All the banks have been guilty of this, in particular Rothschild, Danske Bank, Nycredit and others too many to mention. Perhaps the most blatant ones are ROTHSCHILD AND NORDEA BANK SA. NORDEA BANK in particular who have to answert to the Mercantile Court in Malaga for their misleading/fraudulent advertising, tax evading schemes. Rothschild are not far behind, as we have seen over the last few weeks. They will soon follow the same fate in the Mercantile Court. Our next foray is with the CNMV & continuing court cases to expose these obnoxious banks and their crooked ways. We can only hope that the Spanish Authorities will follow the line of the US Regulators & Courts.