Barclays´ letters seem to dig a hole deeper for them whether it is to insist about the inheritance tax benefits (they still believe it works!) of their Spanish Property Investment Secured Loan (“SPISL”) or, as it happens, to question how could have someone been possibly introduced to Henry Woods Investment Managers, of all agents.

In this latest missive, it says that the banks is not providing advice to you about your own position so you may wish to take your independent advice, but I would hope that you take some comfort from the Bank’s conclusion. And their conclusion is that the bank has satisfied that the scheme is not illegal.

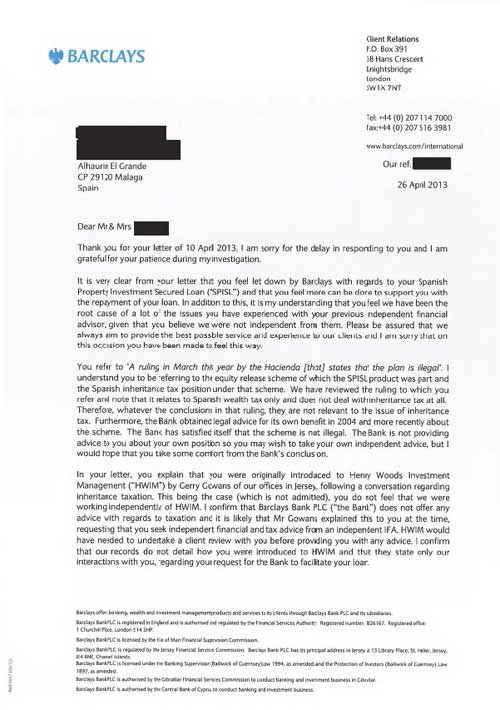

It then says that our records do not detail how you were introduced to HWIM…. perhaps this photo can clarify this seemingly unsolvable enigma, as well as how one ends up dealing with Barclays, offering tax evasion products, from the very heart of the City.

Once again, the rats abandon the sinking ship!

How strange that Barclays bank should tell this customer that the sole purpose of the bank was to facilitate the loan . Would the shareholders of the bank not expect the bank to insist that firms it worked with were at least regulated and gave good sound advice. It would not be acceptable for any company to give loans and Mortgages without due diligence. Do the bank not accept any responsibility for the behavior of any firm it works with. The regulator of the bank I feel would look at this point rather differently.

As for the other points in the letter are Barclays saying that if indeed the Hacienda do confirm the illegality of the IHT scheme they will hold their hands up. It is all smoke and mirrors .I say to Barclays it is now time to put this matter behind them and try to regain some dignity for the bank. If the new man at the top truly wants to make Barclays the ”GO TO BANK” he needs to be made aware of this situation . This will blow up soon for Barclays . We Know Rothschilds and some others are behaving discracefuly in regards to this situation but surely Barclays have more regard for its customers than this.!!!

Is it true that number of Barclays’ victims could reach 70? Yes, according to Costa del Sol IFA sources…

As the going says ” Every picture tells a story ” well usually it does. No doubt Barclays Bank will say that this is a forgery or it was some actors in drag. Barclays know exactly what the score is and like a number of other banks are trying to abandon what we all know is a sinking ship. I agree with Paul, they have been rumbled, so do the right thing and settle with these uinfortunate victims. The last thing you want Barclays is another scandal in your portfolio.

http://news.bbc.co.uk/2/hi/programmes/inside_money/3171015.stm (Reported Earlier but requires highlighting)

Briefly, the above link relates to an article from BBC NEWS world edition on Thursday 21 August 2003. Note the date as this was just prior to Barclays & Henry Woods introducing the equity releae scheme with stockmarket-linked home-income plans. Interesting to note that this article highlights that these schemes/plans were mortgage-based plans where home owners raised a lumpsum by taking out a mortgage for a portion of the properties value. The rest you can read yourself. In 1991, the City watchdog-then the Securities & Investment Board – outlawed these schemes, for two important reasons. First “the mortgage borrowing was charged at variable rates and secondly poor market performance meant the investments fell in value thereby making the scheme unworkable. Under the “Freedom to provide services in the EU, in other words if a service is lawfully authorised in one Member State it must be open to users in othe Member States. The question here, as this type of scheme was not lawful in the UK it should never have been offered in Spain. Barclays Bank is registered in the UK and has to comply with the laws of England, it appears not to have done so. Barclays were not allowed to sell this product in England, so why did they bring it to Spain. They must have known or at least should have know that their product did not conform to UK regulations. Shame on you Barclay for getting involved with Henry Woods (a non registered IFA)

I find it fascinating that the erva investigation team keep finding this evidence. There is little doubt that this dedicated bunch of people which includes their lawyers at Lawbird Legal Services go the extra mile to expose these schemes, how fortunate are we to have such dedication from our friends. We are eternally grateful, well I am. I notice that Antonio seems a little surprised that there could be as many as 70 Barclays victims out there. I am not sure how many have been in touch with erva or Antonio, but I would urge if there are many out there then get in touch. It was the best thing I ever did.

There seems little doubt to me that Barclays Bank should have investigated all aspects of what was on offer and I have no doubt they did. Irrespective of the illegality of this product from a tax point of view, simply by stating that the illegality of the product was on in the relation to “Wealth Tax” as the document from the Tax Office specifically referred to wealth tax issues and did not totally clarify the IHT issue (which I understand from this web site will soon be addressed by another ruling from the tax office: see activity comments from erva) the product is still illegal. They were aware that the mortgage loan was linked to the investement market (if they didn’t they are more stupid than I realise) and as a result this scheme was illegal in their own country (England) as determined by the City watchdog as early as 1991. I wonder if they sold this particular scheme in England in the 90’s and settled the matter before the City watchdog outlawed it, perhaps we will never know as they may have settled under a confidentiality agreement. Barclays should not concern themselves with the Financial Ombudsman in England, but it is a thought. They should be more concerned with what the courts will eventually rule. It is also interesting to note from the letter from “Client Relations” that they are as Rothschild Bank have done trying to divorce themselves from the IFA’s

I do find this letter from Mark 0’Grady (Senior Client Relations Officer) “big title”, intriguing and full of holes. He states that Barclay’s Bank were solely the lenders of the money and had nothing to do with the formation of this equity release scheme. This was all down to Hamiltons. He does admit however that one of their Banks representatives one Gerry Gowan of Barclays Jersey, introduced the banks client to the scheme. Still maintaining that they were independant and only the lenders of the mortgage loan. On the question of IHT they seem delighted that the Hacienda only ruled on the Wealth Tax issue and the ruling was unclear about the illegality of the scheme for IHT purposes. They also admit that in 2004 and more recentlythe bank obtained legal advice about the scheme. I wonder why. As a result they are satisfied that the scheme is legal. I presume from a tax standpoint as this is what they are alluding to. Now my question is a very simple one. If Barclays Bank feel they were only the lenders of the money and were not involved in any way with the marketing/selling of the scheme (that was all down to Hamiltons) WHY ON EARTH WOULD THEY OBTAIN THEIR OWN LEGAL ADVICE IN 2004 AND MORE RECENTLY. And why even respond to their client with such a letter.

Talk about digging a hole for yourself. They seem to be partly there, at least they have burried their head in the sand. Perhaps Mark O’Grady should re open his investigation and finally get to the bottom of this.

Sarah, I am not at all surprised with this letter. Barclays have had their fingers burned in the past over equity release schemes as a result they are desperate to distance themselves from this unsavoury business. There is lots on the Internet if you care to Google Barclays Equity Release Schemes in the nineties.

No doubt all our regular members have picked up the latest post regarding the IHT document received from the DGT. The document will be posted on this web site very shorlly. Perhaps someone should send it along to Barclays to see what they have to say now about their letter. They need to change their lawyers, for someone who knows what they are doing. May we suggest Lawbird Legal Services our own lawyers.