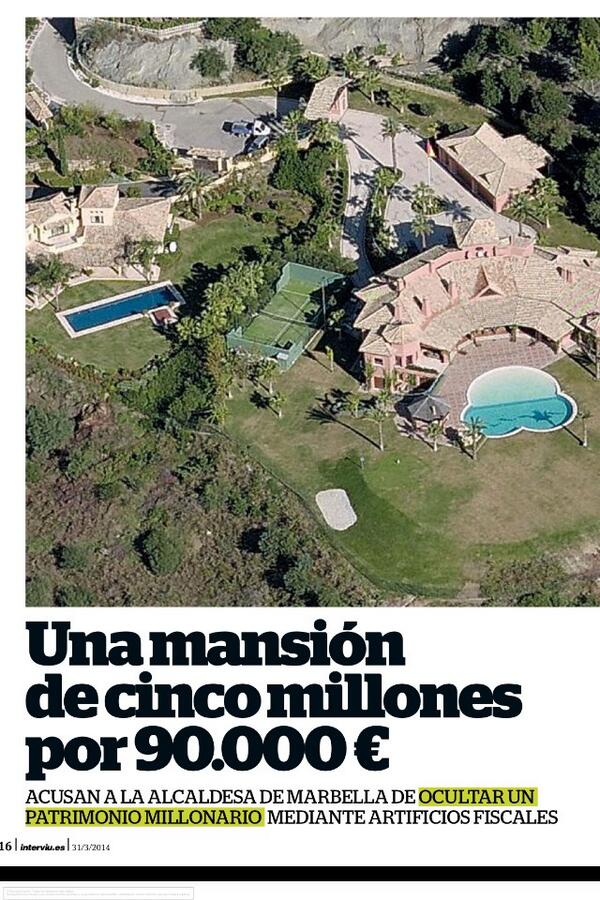

Nordea Bank Luxembourg has been reported nationally for helping the Mayoress of Marbella, Maria Angeles Muñoz, avoid Spanish Inheritance Taxes.

According to Interviu weekly Nordea Bank S.A., operating from the tax haven of Grand Duchy of Luxembourg and through an office in Marbella, sold a tax evasion mortgage to Ms. Muñoz.

This story was originally published by ERVA when it detected that a company owned by the Marbella Mayor and her husband, Crasel Panoramica S.L., had taken out an Equity Release in 2010.

Nordea Bank S.A. has been publicly accused of cheating customers by making them believe that their product is a legal vehicle to avoid IHT, when such a possibility is tantamount to tax fraud.

Spare some sympathy for the Honourable Lady Mayoress . Many highly intelligent people have fallen for these types of schemes which (like all successful scams) are expertly window dressed and skilfully executed.

We may be good at our chosen profession but very few of us have any real understanding of complex financial products and rely on “advisors” to provide this “expertise”. And it is not always possible to determine the integrity of the “advisor” or that the companies they work for (often from the safety of some squalid tax haven) are about to run off with your cash.

Equity Release Schemes (as the name suggests) are designed to release property equity into hard currency and the smell of all that money can encourage the low-life in our society into attempting to entice victims into often worthless investment schemes.

Respectable and clever people can become victims of these scams too!

Very well said PSG. I am aware of so many professional people who have fell foul of the slick talking and fraudulent, misleading advertising. To say that top law and accountancy firms have given their blessing to these products, couple with advertising that states that these taxes can be mitigated under European Law is nothing short of criminal activity. Let us hope, as has been suggested, the politicians in Marbella, not only the opposition, but the Mayors own ruling party take up arms against Nordea Bank. In fact against all banks and institutions that have caused so much misery to expat pensioners, including of course the victims of your own premier shareholders group.

On another subject. As all our Rothschild victims are aware, some time ago Huw Irranca-Davies MP (Shadow Minister) brought up the case of the Rothschild involvement with the equity release debacle in Spain. He has been trying for some time now to set up a meeting with Mr. David Shannon Managing Director, Group Legal & Compliance Department at Rothschild. We have just been informed that the meeting has had to be postponed due to Mr Shannon having been taken ill and hospitalised. What a surprise!!! We at Erva hope that Mr Shannon is not too seriously ill and that he will soon be up and about to meet with Huw. Hopefully Mr Shannon will make some good decisions and relieve the pressure on so many of our members caught up in this crazy scheme. We will of course keep you up to date as soon as we receive further information.

Lovely property, possibly well worth the valuation. So pleased to hear that Nordea Bank have been publicly admonished for their efforts to get their clients to sign up for what now is known to be nothing more that a tax evading product. Never mind the fact that this could never work in the first place, even if there was a possibility of investing in high risk or should I say speculative investments. We all know what happened to all the banks and institutions that invested in Madoff. These schemes themselves were fraudulent as we have seen in the conversation between Danske Bank, as reported on this web site. As was admitted there was no possible way that the scheme could work if the monies were invested in low risk vehicles. As was said there was never any intention of trying to get these to work. It wasn’t important as the IHT & Wealth Tax savings were the main reason why the clients took out these products. Is this fraud or is it fraud. Can’t make my mind up myself. What we need now is for the head of the Spanish public prosecutor service (if there is such a person) to take up the issue on behalf of the Spanish Government and investigate all these banks responsible for selling these catastrophic equity release schemes.

As we are aware, there is nothing wrong and illegal in Equity Release Products. In the UK there are many banks and institutions that offer this service and I presume it works very well. What is wrong is the way they have been sold in Spain. The type of equity release product sold in Spain, was outlawed and published in many UK national newspapers. In fact this type of product gained some notoriety which culminated in a House of Lords case in the 1990’s. This in itself should have been sufficient for these banks/institutions from introducing it in Spain. However they then had the gall to inform people that this could legally avoid/evade Wealth & Inheritance Taxes, knowing full well that this was not the case.

Just read this latest post. Thanks for keeping us up to date. I would comment but think it has all been said.