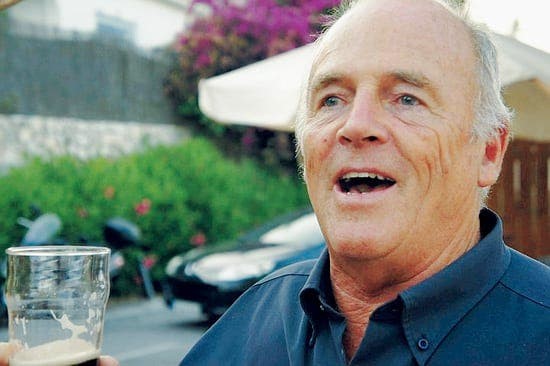

Euan Armstrong, President and Founder of the Equity Release Victims’ Association, has finally succeeded in having his 2004 mortgage loan rendered illegal by a Spanish Court.

When in 2010 Danske Bank foreclosed on the loan and attempted to rob Euan of his Alhaurin home, he could not imagine what a long road lied ahead; immediately upon being served Court papers, Euan’s lawyers instituted criminal proceedings at the Fuengirola Court denouncing the scam he had been a victim of.

When 5 years later the Courts dismissed all criminal proceedings -as a result of a controversial decision by Spanish judiciary governing bodies to not pursue bank contracts criminally- and Danske Bank attempted to foreclose again, lawyers acting for Euan made an almost unheard -and very risky- legal decision: they filed a criminal case against a judge in Coin for admitting a loan foreclosure claim with blatantly insufficient documents.

The Granada High Court in charge of reviewing the case against the judge dismissed the allegations in 2018 -they were described as merely civil- but not before noting, in a short paragraph, that Euan’s allegation of a flawed civil procedure had merits in it. So whilst no charges were brought against the judge, a new Coin judge dealing with the case -who had replaced the previous one for unknow reasons- dismissed all foreclosure procedures on the basis of a technicality.

In 2019, with the threat of loan foreclosure all but eliminated, lawyers for Euan filed the definitive civil claim against Danske Bank International S.A. and The One Life Company S.A. for devising, promoting and selling a misleading and illegal complex financial product, requesting that both the mortgage loan contract and the insurance policies were ruled null and void by the Courts, which is exactly what the ruling has granted.

Lawbird Legal Services S.L.P. (Antonio Flores in the initial defensive actions and Juan Martinez Soler in the latter -and hopefully definitive- Coin Court of First Instance ruling) have acted for Euan Armstrong.

(to be continued)

Congratulations….

Just to inform yout that i tried to settle my case with Rothschild and asked IURA to do the negotiations. Unfortunately i had to payEuro 650.000 to Rothschild and had to pay Tomas Garcia Euro 60.000

A big shame. I feel betrayed by both.

You give hope toall the victims. So…..everybody….lots of succes

Wow

Why no court case ?

Fantastic news Euan

Not only for you and your lawyers determination and never giving up the fight but this will give hope to many in the same situation.

Well done .

Brian

Very good news I lost my home here in the costa blanca ……i was evicted by Nordea Bank.

Well done Ewan. So pleased to see that you won in court so that these lying, cheating banks can be exposed for what they really are!

It is a shame that the Spanish Courts cannot enforce a cheating bank such as Danske Bank to repay their losses to their “customers” whom they misled, cheated, scammed and subsequently failed to defend their actions. Now we await a further time for lawyers to excercise their powers and force the Danske Bank to pay back the Victims of Equity Release. They can run but they cannot hide.

Every day I am writing answers to Danske Bank tweets on Twitter. Today I challenged them to discuss property values when they were stealing pensioners homes in Spain by offering illegal equity releases and losing the investments and then repossesssing the properties as the pensioners could not pay the fees. Of course to offer a 70 year old retired pensioner a 30 year mortgage on their property should be illega. What is illegal is offerring equity release in Spain. And suggesting the value of the property is reduced by the value of the mortgage as it is held in Luxembourg and not Spain…also illegal.

Now Danske Bank International Luxenbourg has sold the investment accounts to Union Bancaire Privee (UBP) in Switzerland for 250.000.000 euros. So now they can afford to pay the victims back!!!

They can run but they cannot hide. Contact UBP and see what they think about dirty money??

Even more shocking news!!!! Danske Bank International, Luxembourg, who accepted 250.000.000 euros for their business in February 2022 have still not settled the scam they did on my property in 2004. They lost two Court cases even after being sentenced by the Court of First Instance in Coin in December 2021 to cancel the mortgage and Insurance policies they created illegally AND STILL HAVE NOT REPAID. Latest scandal is that Danske Bank have sold my debt, which they created by equity release, huge mortgage, three insurance policies then losing almost all the “investment”, to Hispania PTG1, SLU, in Madrid. Hispania PTG1 SLU in turn have not settled with my lawyers, Antonio Flores and Juan Martinez of Lawbird. This is a typical addition to the defaults od Danske Bank which should be kept to the notice of everyone. Danske Bank have been found guilty of many misdemeanours including accepting and laundering black money from the Russians and involved in the Panama Papers (another huge money laundering operation). Danske Bank and its management must be found guilty of these crimes and imprisoned. Fines don’t work

Even more sad news for any Danske Bank “INVESTORS”. When Danske Bank International sold to UBP of Switzerland for the sum of 250.000.000 euros and the account managers moved to UBP (For example Johnny Bisgaard of Danske Bank now holds an executive position in UBP????? Yet he was one of the account managers who lost on my “INVESTMENT” ….,.,, of 1.000.000 euros taken against my property he and his other cronies lost 960.000 euros in 10 years. I also had a personal investment account of 250.000 euros which Danske Bank Luxembourg took and set it against the money they had lost so that my loss now stands at 690.000 euros !!!!!!! How can that be legal? Mind you nothing else was legal. Time for these people to be held to account