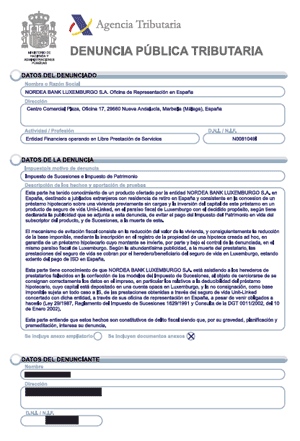

Having been made aware that NORDEA BANK LUXEMBOURG may be assisting inheritors on the delicate issue of filing IHT returns in respect of deceased subscribers of the tax-evading Nordea Mortgage + Unit Linked Policy package, it was deemed convenient to report this to the Spanish Tax Office.

Having been made aware that NORDEA BANK LUXEMBOURG may be assisting inheritors on the delicate issue of filing IHT returns in respect of deceased subscribers of the tax-evading Nordea Mortgage + Unit Linked Policy package, it was deemed convenient to report this to the Spanish Tax Office.

The “denuncia” informs the authorities that NORDEA Bank Luxembourg S.A. could be advising inheritors on how to fraudulently register the mortgage loan in the tax form, as a real debt, also fraudulently leaving out the value of the unit-linked policy altogether, even though the sums obtained by the inheritors are fully taxable in Spain whether the inheritor is a resident, or not, contrary to Nordea’s publicity.

Tax Fraud is a crime prosecutable in Spain where the sums defrauded exceed €120,000.

A unit-Linked policy worth €500,000 inherited “abroad” and not declared in Spain, that is, with the assistance of Nordea’s Jesper Hertz (Marbella) and Jhon Mortensen (Luxembourg), would defraud the Spanish Tax Office €125,805.34…

This actually coincides with information received from one of my girl friends, which I reported on, in another comment. I have been in touch privately with the ERVA TEAM and have given them details. It is important that we bring all these matters to the attention of the authorities and obtain a firm ruling from the Tax Authorities. It has been stated that it should be a relative simple matter for the Authoriites in Madrid to check their records to see which banks have Unit Linked Life Assurance Policies as part of their mortgage loan and as a result what IHT was charged. We certaInly need some answers, as to whether these schemes are legal are not. Fromthe information posted on this web site they would appear to be not. All these banks should be totally transparent and all tax avoidance/evasion stamped out.

That is a damming statement to make against Nordea Bank SA. I hope erva have the proof to make such a statement, otherwise it could lead to some serious action by Nordea Bank SA. However in the past I understand that nothing is posted on the Internet that would not hold up in Court, so I presume they know what they are doing. I guess we will soon know one way or the other.

Dear Sir/Madam,

I wish to report a major tax evasion scheme being carried out by Eduardo and Marlies pla Masia who own pla agencia inmmobiliaria, an estate agent located in calle de mar 59, 03700, Denia.

We recently purchased a property from this estate agency.

The fees payable to the estate agent were 5000 euros and when we paid it on the 19th of February, they refused to give us a receipt.

They said that we will need to pay their iva tax if we wanted a receipt.

This activity is clearly illegal and they are carrying out severe tax evasion!

In bad economic times like we have in Spain and the rest of Europe, every government needs as much contribution from businesses like pla agencia inmmobiliaria in Denia so that we can all get back on the road to economic recovery, and help people who are suffering and out of work.

We are not going to settle for illegal tax evasion being carried out like this and want you to apply the full force of the law to stop Eduardo and Marlies pla Masia from evading their tax obligations.

We all have to pay taxes, so why should they be allowed to get away with it.

I would imagine we are not the first buyers to be treated like this by Eduardo and Marlies pla Masia, but I am determined that this illegal estate agent is shut down so they cannot do this anymore.

Look forward to hearing from you soon.

Regards

S Ansari

Hello Stephanie,

Thank you for your post. Whilst we are primarily concerned with fraudulent tax evasion equity release schemes, we like you are amazed at how many of these tax dodges go on. In fact we have received numerous complaints from clients of many banks, estate agents and non registered valuers. We are determined to expand our interests into other fraud and tax evasion measures. I will speak to our lawyers on this matter. Meanwhile go back to the office and insist on a receipt. Tell them if this is not forthcoming you will denounce them to the police and tax authorities.

pjames is correct of course. However as you have probably realised in the past erva are very careful not to post anything that they cannot provide evidence for. In this case we have all we need to defend any libel case that Nordea can throw at us. Now it is up to Nordea Bank to challenge this statement.

If true, this is disgraceful, but well done erva. You evidently have good intel on this subject. I find it hard to believe that Nordea Bank and lawyers would need to go to such lengths, why would they get involved if they were not very worried about the implications of their scheme. Surely this is not a matter for the banks. If there has been a bereavment in the family it is up to the relatives to file the claim in Madrid and providing they have given full details of the mortgage and Unit Linked Life Insurance Policy it is up to the Tax Authorities to determine the amount oif IHT payable if any. Whoever is involved, should bear in mind that the onus is on him to report the true facts to the Tax Authorities. I am certain that if this came to light then Nordea Bank would wash their hands of it.

FROM THE ERVA INVESTIGATION TEAM

First we would like to thank Sarah for reporting back and providing full details of the mortgage provider in volved. At his stage we are not prepared to publish the name, however it will be forwarded on to the relevant Tax Authority through our lawyers. As you will be aware the Spanish Inland Revenue and othe Tax Agencies are becoming more aware of these tax avoidance schemes, no doubt as a result of the European press and media. Many of you will no doubt know someone who has been investigated by the Authorities for tax avoidance. Gone are the days of the Spanish laid back attitude to tax. Spain is in desperate trouble and the Authorities are determined that people should pay their fair share of tax. So called Tax Havens such as Luxembourg where Nordea Bank SA & Danske Bank SA operate from are coming under close scrutiny, any mention of these banks operating from Luxembourg throws up of “flag” As you will have heard Switzerland is virtually under seige by the USA Authorities, perhaps not before long the activities in these countries will be heavily curtailed. Erva advise everyone to looki closely at their affairs and make sure that they are legal. Finally ” ERVA WOULD WELCOME ANY INFORMATION ON THE SUBJECT OF THIS POST” Please do it privately to erva and it will be treated as Private & Confidential.

This is not only to do with Unit Linked Life Insurance Policies attached to mortgage loans. In fact it is far more simple than that. The crux of the matter is where the motgage loan was given on an otherwise non encumbered home, the money then taken of shore and hidden in a so called “tax haven” and then hidden from the tax man on the death of the owner is a “simulated” loan. If this was not explained to the authorities then this is tax evasion.

Thank you all for getting in touch with the ERVA team. Your information will of course be treated with the utmost confidentiality. We urge everyone who feels they may have problems with their IHT bill, to speak to their respective lawyers. As Karen has stated, if one has signed an Equity Release Agreement with any bank and a mortgage loan was granted on a previously unencumbered property, in the event of death then it is imperative that your lawyer is informed of the precise details of your loan. If the loan is taken offshore and invested then this must be explained to your lawyer and divulged to the Tax Authorities, which will then be taken into account when your IHT is being worked out. Remember it is your obligation to do this and not the bank. Trust us, if you are found out the banks will not take the responsibility and wash their hands of any wrong doing. As we have seen from the Uria & Menendez document previously posted on the web site, this is nothing but a ” SIMULATED” loan to evade IHT. On the other hand if all details have been correctly divulged to the Tax Authorities and you have legally reduced your IHT then you have nothing to worry about. Would it not make you sleep better at night to know you will not be having an unwelcomed knpock on your door.

Dear sir

Who do I need to contact in order to report two British residents of Spain for Tax evasion. They both own and run 3 websites from there home address. They also charge numerous companies fees to advertise on the said websites. They claim to have an annual income of over 20.000e per year.

Andrew Taylor.