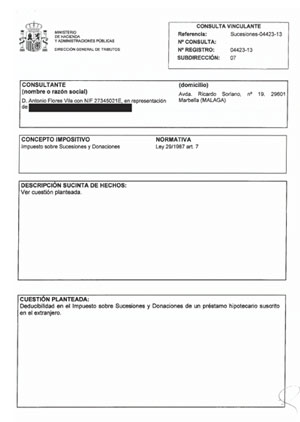

Spanish Tax Office is insistent: customers are exposed to tax fraud if equity release mortgages are deducted from the estate calculation

But then Steve Dewsnip, from Rothschild, used to say the following:

“At Rothschild we are insistent that customers are not exposed to unexpected risks…”

And we now say: Steve, yes they are, so much so that only in respect of the tax matter, where the amount defrauded exceeds €120,000 per annum, there are jail terms ready to be handed down (Alhaurin penitentiary opening its doors to trusting clients?). Not to mention of course other risks that the product had to offer, in spite of Rothschild’s ultra-cautious approach: legal risk, currency risk, investment risk and not the least, health risk.

Barclays’ Senior Client Relations Advisor had stated in a letter published in an earlier post the following:

“We reviewed the ruling to which you refer and note that it relates to Spanish wealth tax only and does not deal with inheritance tax at all. Therefore, whatever conclusions in that ruling, they are not relevant to the issue of inheritance tax…The Bank satisfied itself that the scheme is not illegal.”

Two things on this:

- The scheme is not illegal per se, what is illegal is the sale of the scheme as a way to mitigate taxes and the pursuit of a tax benefit, as Barclays did, among other misrepresentations (such as it being a fantastic product for pensioners because it would provide an additional income stream to their retirement income etc.).

- The Tax Office has taken exception to the letter by Barclays and has specifically addressed the Inheritance Tax mitigation matter, rendering it openly as “Tax Fraud”. This means that Barclays is, prima facie, guilty of devising, promoting, endorsing and selling a product that is Tax Fraud.

And if the above holds water -which it clearly does- by extension all other schemes promoted by many other banks are illegal.

Thanks for posting this very important document. Barclays will now have to think of a way to explain this to its customers. This document clearly states what Barclays and other banks have done is to encourage clients (unknowingly) to commit tax fraud. It will be interesting to see how Barclays try to explain the position they are in. They no doubt will say that the advise they took from some big law firm expressed the opinion that the avoidance of IHT by this method was legal. It IS, AND WAS NOT. We have seen this from the other banks, this stance will only lead to litigation. Barclays can not win the case . If the Hacienda allow them to win the president set will open the door for more of the same.

In the meantime some of the banks clients are aged and in ill health, in some cases this can be attributed to the stress caused by an uncertain future.

Litigation in Spain against Barclays is coming.

The thought of Barclays continuing with the denial of any wrong doing or lack of due diligence,compounding the agony and stress for its customers is hard to contemplate.

Should Barclays and Mr Jenkins in particular be truly interested in its customers and the reputation of Barclays it should now contact all the affected clients and resolve the problem to the clients satisfaction.

I could not agree with Paul more. All the banks, including Barclays, Rothschild, SLM all UK domiciled banks. Danske Bank, Nordea Bank SA, both domiciled in Luxembourg. Nycredit, Sydbank, Jyske Bank, and many other Scandanavian banks who promoted this product under the pretense of evading both wealth & Inheritance taxes got it all wrong. Who knows, perhaps they were mis-lead by their agents or Spanish tax advisors or both, the truth is they should have checked themselves. All these banks have a multitude of in-house lawyers & tax advisors, who should have known different. It wasn’t that these were new laws and regulations, they were in place long before they started to sell these illegal products in Spain. Whatever the reason their victims should not be taking the blame for their mistakes. The banks have ignored this for many years and have put their clients under enormous stress. Is it not time to settle with their clients and put the whole matter to rest. I was going to say they should be suing their own agents and their Spanish lawyers for mis-information and not their clients, however tey probably realise that they have no money to compensate the banks. If there is any possibility in these banks rescuing some of their reputation, NOW IS THE TIME TO ACT. There seems little doubt that erva lawyers Lawbird Legal Services and their head lawyer Antonio Flores are not going to let this rest.

The receipt of this document from the Spanish Tax Ministry, is very clear. The banks have incited our members to commit INHERITANCE TAX FRAUD. A similar document recently posted on this site declares the same for WEALTH TAX FRAUD. So where do we go from here is the quesrion. The banks are still burying their heads in the sand, hoping that these problems will either go away or that erva lawyers will give up their fight due to the costs involved. Mr. Banks, trust me this will not happen, Lawbird Legal Services and Antonio Flores are committed to fight for as long as is neccessary to bring you either to the courts or the negotiating table. Lets recap on the story so far. Lawbird Legal Services have lodged the following writs into court. Danske Bank Luxembourg are still under investigation for criminal activities. Nordea Bank Luxembourg currently have three civil writs to answer. One case in the Mercantile Court, Malaga for illicit and fraudulent advertising( A provisional hearing is set for October). And two writs in two seperate courts to null & void mortgage loans as they were entered into, to evade both IHT & wealth taxes. As you will have seen on the web site another writ will be lodged in the Mercantile Court, Malaga on Friday 7 June, for illicit advertising. This we understand will be on behalf of several clients of Lawbird. Similar writs are currently being finalised for several other banks. Landsbanki are also under pressure where a combined Spanish and French group have filed criminal charges in Luxembourg. Other lawyers, we believe have also issued writs in Spanish Courts. Landsbanki have had one succes to date where a Spanish Court ruled in favour of a Spanish victim. We also understand that there are a number of other cases being pursued in English Courts against several banks. As you can see, matters are progressing, perhaps not as quickly as some of us wouild like,however this is Spain, however, these matters do take time. We hope at erva, that this post will give you some encouragement and comfort and we ask you to keep your comments coming. One other thing we would ask, if anyone has any documentation from any bank that promises TAX BENEFITS then please get in touch with us or Antonio Flores. We need all the evidence we can get to submit to the courts.

MESSAGE FROM YOUR ERVA TEAM.

A number of our members have asked if they could have coipies of the document to give to their own lawyers. The answer is YES. Antonio and erva feel that this document is of such importance that we should share it with everyone. Erva would like to thank Antonio, for all his efforts and the way he is prepared to help all vicims of equity release fraud by obtaining and sharing all this information. Unlike most lawyers, who guard everything they do. If only they would share information our quest would be much easier. We are all victims and should be working closer together.

This document is so important to me and I am sure all our members and victims of equity release tax fraud. We have all suffered greatly by these banks, not only financially but mentally as well. Personally I have been at my wits end wondering what the rest of my days on earth will be like, if we don’t get justice. Just by reading this and logging on to this wonderful web site has given me enormous resolve to carry on. Whoever you are erva, GOD BLESS YOU and thanks a million. Would you please thank Antonio for everything, second thoughts, I will do it myself.

I have a document which is from OIB (SLM) and is an illustration of the Inheritance tax which would be saved by taking out this “mortgage”

After months of poverty, misery, ill health, stress, frustration I can perhaps feel there is a candle burning in a long tunnel far far away. Dare we start to consider that these banks who stole our money on the pretence of giving us an income and offering us a way to avoid inheritance tax EVENTUALLY have to be made to answer for their total incompetence by losing our money and distributing it among their directors and CEOs. Maybe maybe justice will be seen to be done. The members of the EQUITY RELEASE VICTIMS ASSOCIATION owe everything to Antonio Flores and his legal team (LAWBIRD OF MARBELLA) who have worked through negative responses from Courts and even the Highest Supreme Court of Spain. They never gave up against all the odds and gave us encouragement at every step of the way. Let us all now stand up shoulder to shoulder and fight against these banks and their trickery. Authorities like LUXEMBOURG must be charged with permitting large powerful entities to operate under their umbrella of offshore tax benefits. The more evidence we have proving any actions these banks deliberate took to mislead its clients is important to assimilate so we can act strongly against them in an attempt to speed up the long legal process.

Neil. I am not sure if Antonio has it. Would you please post the title of the document and I will check with our Lawyers. Alternatively, if the document is not too long, scan it and send it to Antonio or ourselves. Many thanks,

Erva Team