Can you trust this man? Definitely not, if he is trying to sell you a mortgage + life insurance/capital assurance product.

Can you trust this man? Definitely not, if he is trying to sell you a mortgage + life insurance/capital assurance product.

Can you trust his company? As above.

Why? Because he will be lying through his teeth, as he has done in countless occasions in the past, and will tell you that this product is a fantastic opportunity for expats that have no mortgage on their properties as it will give them access to cash and also, eliminate taxes, none of which is true. Additionally, he will tell you that your property will never be at risk and that you should trust them because of their Nordic values, which he claims other bankers don’t enjoy. So far a few people have had their homes repossessed.

What do you mean by Nordic values? Nordea says that their company and staff are imbued of certain principles (integrity, impartiality, honesty, directness, flexibility and the ability to understand and treat clients like human beings), and that this differentiates them their competitors. If we interpret this literally, it would mean that bankers from say Afghanistan, Chile, Somalia or Spain lack integrity, are dishonest, biased and treat clients like animals…

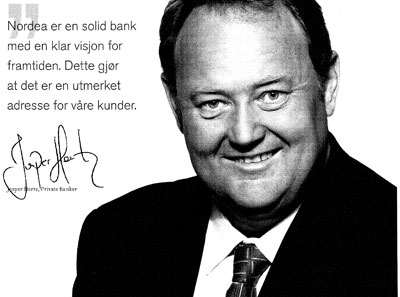

What was this man’s role in the selling of Equity Release? Jesper Hertz was in charge of selling and signing off Equity Release products for Nordea Luxembourg in Spain. Wherever his company was not present, like in the Alicante/Murcia areas, he would reach out to potential customers through an agency network of rogue financial advisers, imposters who had easy access to the British expat community through years of presence on the Spanish Costas.

Did Jesper Hertz tell his customers that they would never lose their homes? Absolutely. Had he been transparent and honest, not one of his customers’ homes would have been at risk because not one would have signed the product, as simple as this. It was the obligation of Nordea, and Hertz, to specifically indicate their customers that this was a fraudulent product. On the contrary, Nordea’s mission was to come across as an elegant, sophisticated and trusted bank that would look after you to and, as they repeatedly insisted, preserve your wealth and look after your loved ones.

Their literature makes ludicrous and false statements such as : home sweet home…your most precious asset…keeping it in the family…our in-house specialists possess a deep and extensive knowledge of these virtues…we ensure that our advice is always open-minded, direct and honest so that we never promise you any more or any less that what is realistic…trust us…let us be your confidant.

You are talking about fraud, now that is a serious allegation! Jesper Hertz, from his office in Marbella, marketed, promoted and sold the virtues of a tax evasion cross-border service, similar in concept to the one UBS set in the US that cost them a criminal indictment (PDF). Although far modestly in means and resources compared to the Swiss bank, Nordea has still managed to create a refined set of promotional brochures that minutely explains how legal it is to register an artificial mortgage on your home, take the proceeds to a tax haven and have your inheritors receive the money abroad, without paying taxes, whenever you pop your clogs.

Why is it all wrong then? The problem is that you cannot register an artificial mortgage to make the tax authorities think that you have a real one, it is just illegal. And yet, Nordea Luxembourg organized a marketing campaign based on this premise. Secondly, it is wrong to tell your customers that you can inherit the proceeds of a life insurance/assurance product without paying taxes, quite simply because the law says that you pay IHT in Spain, whether you are a resident or a non-resident (and irrespective of the policy-holder being a resident or not).

How would you summarize Nordea Luxembourg Equity Release product? Tax cheating, customer deception and lack of values, all in one.

One would imagine that such a statement must surely end up with a claim for libel, defamation of character etc. in fact they should throw the book at you. At least one would expect a letter from their lawyers asking for an apology and retraction. Will it happen I wonder. Having said this let me explain the true facts of this fraudulent equity release scheme.

Mr Hertz should have explained it in this way and would be in keeping with their true Nordic values.

Thank you for your interest in our Equity Release Scheme, however I must explain the true nature of this, product.

1. Although we claim that there are tax benefits,such as mitigating or in some cases eliminating IHT and Wealth Tax, its not entirely correct Our lawyers have stated that the Spanish Tax Authorities could challenge this, that also is applicable to the Wealth Tax. So in all honesty we could not guarantee there would be a saving.

2. In any event the scheme we have devised is as follows. We will value your home (you don,t have a mortgage on this, do you?) We Nordea Bank SA Luxembourg will then loan you up to 90% of the value, and we will allow you to take 25% out as cash to spend as you wish. Go and buy yourself a nice new car or something.

3. The balance of the money we now take to Luxembourg or some other tax haven and give it to our sister company, in the case of Luxembourg to Nordea Life and Pensions. Now you really have to understand that once we do this the money does not belong to you but to Nordea Life & Pensions, in a unit linked life insurance policy (single premium)

4. Now what happens is that Nordea Life & Pensions give it back to Nordea Bank SA in Luxembourg who invest it in a variety of financial instruments. Again I have to be perfectly honest with you. You have in fact signed up to a discretionary managed capital plan and as such you have no influence in what we do with your money, however I must stress that if we lose your the money, then it is your responsibility and not ours. Unfortunately we have to do this in order for us to comply with the Luxembourg regulations. Also under Spanish Insurance law it is not deemed to be a policy of life insurance unless it is place in a dedicated fund where the policy holder has no influence.

5. As I have stated you really need to think carefully in what you are doing. For example as I have explained to you, you are risking losing all your money in the investments. If this happens then we will foreclose on your property to make up the money we have lost on behalf of Nordea Life & Pensions.

6. Having made up our minds to foreclose on the property, you really don’t have a defence unless you can put a case forward that shows we have been fraudulent, which of course is why I am being absolutely honest with you. If your property is repossessed it will be sold at auction, however it is not normal that there will be any bidders. If this is the case then the property will be given to the bank at 50% of its value. If of course this does not cover our costs then we will sue you for the balance, wherever you live in Europe.

7. What I have not yet explained is what the purpose of such a scheme is. Well it is quite simple, the return on the money we invest is supposed to pay the interest on the mortgage loan and give a you some extra funds. Well that is our job, but in all honesty we would have to return you some 7% -8% in order to do so over the next 10 years.

8. Well what do you think of our Equity Release Scheme. Pretty good business for us, we have nothing to lose and everything to gain. Would I risk everything knowing what I know MR. Hertz says. Do you think I am stupid or something.

It is outrageous if this information was concealed from you by Mr. Hertz et alia, of Nordea Bank. Surely banks are obliged (by law) to provide detailed information at the outset?

What horrendous things have happening to unsuspecting people ,I hope and pray that the Spanish

authorities will take action to sort out this situation and the Banks involved and leave no stone unturned.

A recent article in El Pais by Jesus Garcia (Barcelona) 16 Oct 2012 – 18.05 CET. Heading ” CEO charged in investment fraud ” A Barcelona judge has accused the CEO and the bank which specializes in investment products, for defrauding a client. The information given by the bank on highly complex investments were misleading. The information given (according to the article) was “flawed,limited,misleading and ultimately deceitful and misleading” The crux of the scam was qualified by the judge was hidden from the customer. Although it was said that even though there were many elements to discourage the investor he was not made fully aware of the risks at the time. A full translated version can be found on aflores twitter, should you care to download this. Reading this article it begs the question. If the judge found this product misleading and fraudulent, I wonder how he would have ruled on the Equity release scam that has grown to such noteriety in Spain by the many foreign banks that have sold such products. For example, like the case reported was there a real chance of success of these products ever working, taking into consideration the interest rates charged on the monies borrowed, especially when in most case some 25% of the loan could be released out of the equity of the house. Could it really be envisaged that the investments would yield sufficient to cover the interest costs. More importantly was it spelled out that you could lose all the investments and as a result were you told that you could have your house repossessed. It would seem from this ruling that there should be a number of Banks CEO’s and managers reconsidering their future. Mr Hertz included of course. Perhaps all the cases in the civil court should be transferred to the criminal court.