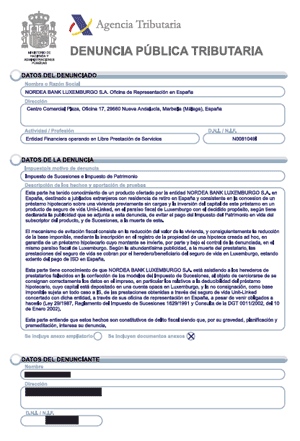

Having been made aware that NORDEA BANK LUXEMBOURG may be assisting inheritors on the delicate issue of filing IHT returns in respect of deceased subscribers of the tax-evading Nordea Mortgage + Unit Linked Policy package, it was deemed convenient to report this to the Spanish Tax Office.

Having been made aware that NORDEA BANK LUXEMBOURG may be assisting inheritors on the delicate issue of filing IHT returns in respect of deceased subscribers of the tax-evading Nordea Mortgage + Unit Linked Policy package, it was deemed convenient to report this to the Spanish Tax Office.

The “denuncia” informs the authorities that NORDEA Bank Luxembourg S.A. could be advising inheritors on how to fraudulently register the mortgage loan in the tax form, as a real debt, also fraudulently leaving out the value of the unit-linked policy altogether, even though the sums obtained by the inheritors are fully taxable in Spain whether the inheritor is a resident, or not, contrary to Nordea’s publicity.

Tax Fraud is a crime prosecutable in Spain where the sums defrauded exceed €120,000.

A unit-Linked policy worth €500,000 inherited “abroad” and not declared in Spain, that is, with the assistance of Nordea’s Jesper Hertz (Marbella) and Jhon Mortensen (Luxembourg), would defraud the Spanish Tax Office €125,805.34…