Spanish Tax Office is insistent: customers are exposed to tax fraud if equity release mortgages are deducted from the estate calculation

But then Steve Dewsnip, from Rothschild, used to say the following:

“At Rothschild we are insistent that customers are not exposed to unexpected risks…”

And we now say: Steve, yes they are, so much so that only in respect of the tax matter, where the amount defrauded exceeds €120,000 per annum, there are jail terms ready to be handed down (Alhaurin penitentiary opening its doors to trusting clients?). Not to mention of course other risks that the product had to offer, in spite of Rothschild’s ultra-cautious approach: legal risk, currency risk, investment risk and not the least, health risk.

Barclays’ Senior Client Relations Advisor had stated in a letter published in an earlier post the following:

“We reviewed the ruling to which you refer and note that it relates to Spanish wealth tax only and does not deal with inheritance tax at all. Therefore, whatever conclusions in that ruling, they are not relevant to the issue of inheritance tax…The Bank satisfied itself that the scheme is not illegal.”

Two things on this:

- The scheme is not illegal per se, what is illegal is the sale of the scheme as a way to mitigate taxes and the pursuit of a tax benefit, as Barclays did, among other misrepresentations (such as it being a fantastic product for pensioners because it would provide an additional income stream to their retirement income etc.).

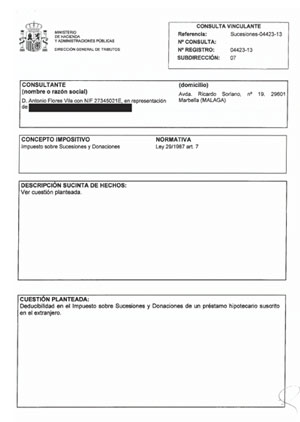

- The Tax Office has taken exception to the letter by Barclays and has specifically addressed the Inheritance Tax mitigation matter, rendering it openly as “Tax Fraud”. This means that Barclays is, prima facie, guilty of devising, promoting, endorsing and selling a product that is Tax Fraud.

And if the above holds water -which it clearly does- by extension all other schemes promoted by many other banks are illegal.