The DGT (General Directorate of Tax) has confirmed that mortgage loans for any other purpose than buying the property on which they are registered, are not deductible for Spanish Inheritance Tax Purposes.

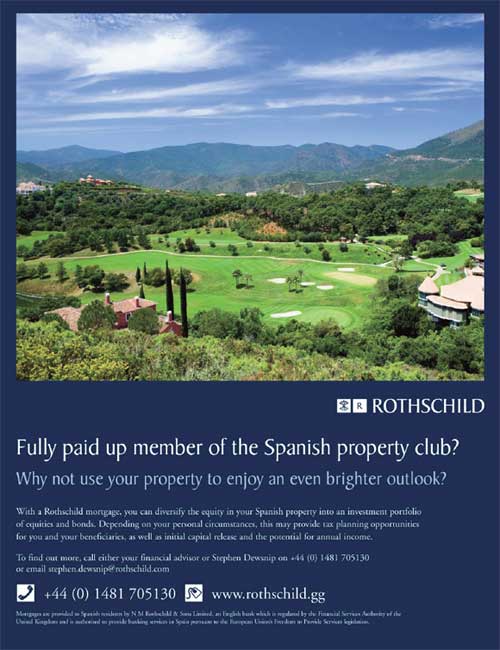

Binding consultation 04423-13 received by Lawbird lawyers today (28th May), refers also to loans granted abroad (such as those by Rothschild, SLM, Nykredit etc.) that are guaranteed by mortgages on Spanish property and is adamant: only real debts can be used to mitigate taxes.

Nobody questions that N.M. Rothschild & Sons could and should have ensured that the product they were selling was legitimate, just like any diligent person carrying out any commecial activity in Spain would do (and indeed any where in the world).

Instead, they chose to make their clients accomplices of tax fraud because some inept lawyer at Gomez Acebo & Pombo decided that it was legal, at the insistence of clowns Mark Coutanche and Steve Dewsnip, to run this circus.

Claimants will demonstrate that all the publicity issued by Rothschild, and the companies they used to sell the product CreditSelect Series (as confirmed by honest and helpful former employees) is false, fraudulent, encouraged tax evasion and has caused untold grief on victims.

The legal suit against Rothschild is to be lodged with the Malaga Mercantil Courts on the 7th of June 2013.

It is good to hear that Lawbird Legal Services have finally received this Consultation from the DGS. Erva and their lawyers have been waiting for this clarification for some months now. Yet again they are true to their word. It would seem to me that the light at the end of the tunnel is getting brighter every minute. What other excuses can these banks now bring up. It is now a case of getting these writs into court and for everyone to get properties and lives back. Will this document be posted on the web site as was the document regarding the wealth tax issue.