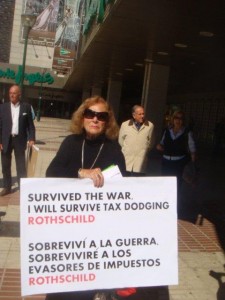

The statement below was made by a RV (Rothschild Victim). Names have been ommited to preserve confidentiality.

This statement fully validates Mr. Nott’s honest and truthful affidavit, and exposes the lies of the “Rothschild” brand.

Mr. Dewsnip, let your conscience be your guide and sever ties with your former utterly dishonest employers. You were economical with the truth on stand once, don’t dig a deeper hole for yourself.

Mr. Donald Nott of Henry Woods, a company trading as financial advisors previously known to us, telephoned to say that he was arranging a seminar in the Javea, Parador hotel and that a Mr. Stephen Dewsnip, a senior director of Rothschild Bank, would be giving a talk on a Rothschild financial product known as the “Rothschild Credit Select Series 4 Equity Release Plan”.

Due to a previous commitment we were unable to attend the seminar and instead asked Mr. Nott to come to lunch at our house, an occasion which would provide him with an opportunity to explain the “Rothschild Credit Select Series 4 Equity Release Plan” in greater detail.

Mr. Nott agreed to this arrangement and then asked if he could bring Mr. Dewsnip, the Rothschild Bank director, with him. We agreed to this and felt quite honoured to have a director from a prestigious bank in our home. Both men arrived at 12.30pm and we enjoyed some convivial, pre-lunch drinks together.

The smartly dressed Mr. Dewsnip appeared to be on extremely good terms with Mr. Nott.

Both were very courteous and once lunch started Mr. Dewsnip began to explain the Rothschild Credit Select Series 4 Equity Release Plan. Mr. Dewsnip advised us that, in view of our well-defined financial circumstances, the Rothschild scheme would be an ideal “investment” as it would release equity locked-up in our home, provide another source of income and reduce inheritance tax. The entire scheme, he assured us, was underwritten by a Rothschild Bank loan that would be guaranteed for 10 years.

Mr. Dewsnip was aware that my husband John John, a retired Army officer, had a small pension and Mr. Dewsnip also fully understood that the only accessible capital we had was tied up in our home. He advised both my husband and I that Rothschild Credit Select Series 4 Plan would be financially beneficial to us as the equity released in our home would provide us with an initial lump sum of up to 5% of the value of the house, and the “income” following on from investing the remaining money in a “financial product” would provide an annual net income of up to 3%.

Mr. Dewsnip wholeheartedly assured us that the Rothschild Credit Select Series 4 Equity Release Plan was guaranteed by Rothschild Bank and was particularly appropriate for elderly people not wishing to move house again. And that Rothschild Bank would not involve anyone, particularly pensioners, in a hazardous financial product that would expose them to unexpected risks.

We are inherently adverse to taking financial risks of any kind but the assurances we received from Mr. Dewsnip, director of Rothschild Bank who was actually sitting in our house and eating our food, was sufficient to convince us that the Rothschild Credit Select Series 4 plan was a safe and appropriate plan consistent to our financial circumstances. And it was the advice received from Mr. Dewsnip, a director of Rothschild Bank, that finally persuaded us to enrol in the Rothschild Credit Select Series 4 Equity Release Plan.

At no time during our lengthy conversation with Mr. Dewsnip did he draw any distinction between the names “NM Rothschild & Sons” and “Rothschild Bank International”.

At all times Mr. Dewsnip referred to his employees as “Rothschild Bank” and if there is a legal distinction between the two entities then Mr. Dewsnip failed in his fiduciary duty to disclose this information and in doing so misled us into entering into a contract.

ng their legal defence on 2 items:

ng their legal defence on 2 items: